5 Steps to Developing a Profitable Trading Plan

By Dale Gillham

Most traders want to learn how they can improve their chances of success in the stock market, which is why I am often asked 'How can I trade more effectively?' While many variables contribute to becoming a successful trader, one of the most critical elements is having a written trading plan, as it helps to identify the type of trader you want to become.

In this article, I share my five steps to developing a profitable trading plan, which will ensure you not only trade more effectively but you are better prepared before entering a trade. It also improves your probability of making profitable trades and increases your likelihood of success in all financial markets.

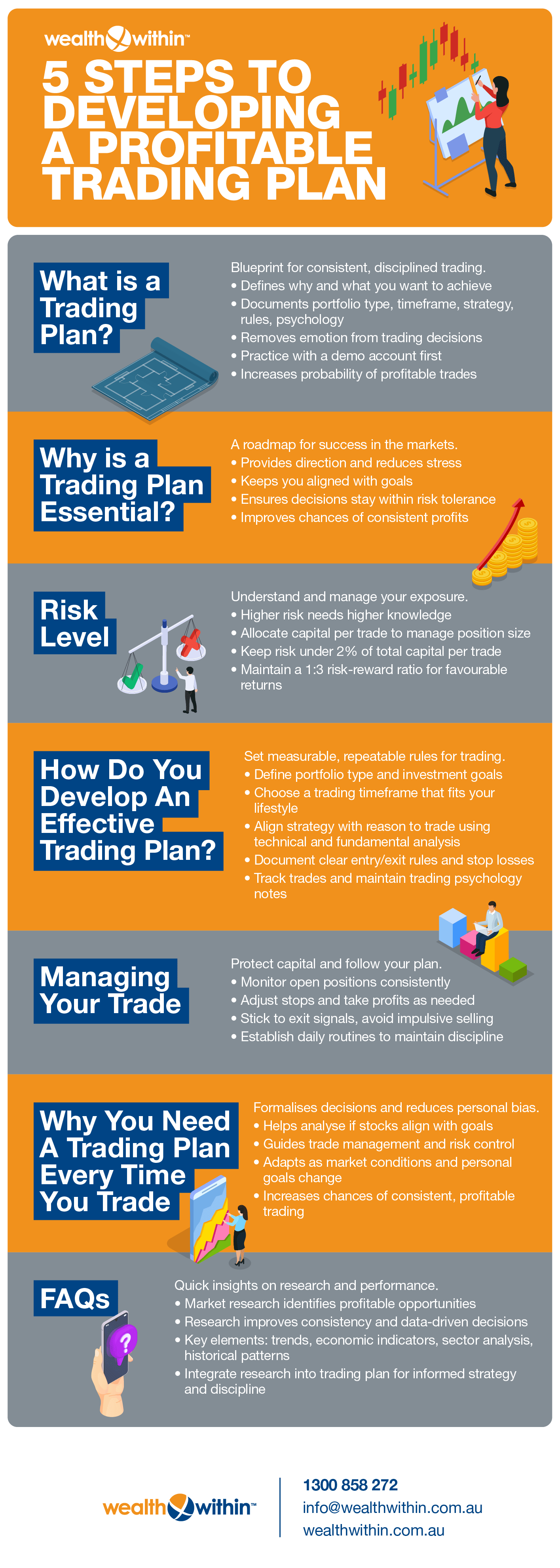

What is a Trading Plan?

A written trading plan helps to identify why you are trading and what you want to accomplish. It also provides the basis for your trading decisions and the actions you need to take when making a profit or loss. It removes the emotions, as you can make more informed decisions because you have taken the time to analyse and document how you will manage each trade before you enter the market. This is no different to professional traders or those who trade full-time for a living.

A trading plan includes:

- the type of portfolio you intend to trade

- your investment time frame

- how your trading strategy and trading rules support your reason to trade

- your money management rules, and

- your notes and psychology rules.

Using a demo account allows you to practice and test your trading plan in real market conditions without risking real money.

It may surprise you to learn that the majority of individuals who trade financial markets do not have a written trading plan, which explains why so many traders fail to be consistently profitable. In contrast, those who have a solid trading plan claim they achieve greater success when they stick to it.

Why is a Trading Plan Essential?

In the stock market, your roadmap is your trading plan. When we don't have a plan, we often live in the hope that we won't suffer the consequences of our actions. Unfortunately, without a solid trading plan, you are wasting time in a futile exercise to generate profits.

But when you know what you're aiming for, you have a much higher chance of success and less stress, and you're more likely to achieve your trading goals and financial goals. But that all comes down to you staying within your risk tolerance.

Risk Level

There is an undeniable link between risk and knowledge. The more risk you take, the higher the level of knowledge required to manage it, which is why it’s important to always manage your investment risk.

Risk tolerance is the degree of risk you are willing to take with your investments. Usually, the higher the risk, the higher the expected return. In some cases, the risk is almost zero and, in other cases, it is very high. For example, investing in a term deposit is virtually risk-free and requires almost no knowledge.

When planning your trades, it is important to calculate how much capital to allocate to each trade to ensure effective risk management and position sizing. Consulting a financial advisor can help assess your risk tolerance and provide personalised guidance tailored to your financial situation.

Investing in the stock market, however, involves a higher degree of risk, which requires a much higher level of knowledge and skill. Understanding your tolerance to risk will help maximise your wealth creation potential. Risking more than 2% of your total trading capital per trade is considered high risk. Additionally, a risk-reward ratio of 1:3 or higher is commonly recommended for trading to help ensure favourable returns relative to risks taken.

Risk Appetite

I always recommend that an individual’s risk appetite be determined by what I like to call the ‘sleep factor’. In other words, you should only ever invest in assets that allow you to sleep at night. Believe me, it is far better to sleep than worry about how your investments are performing.

Before you trade, you need to consider whether your risk appetite is low, medium or high. Asking this question will help to determine the risk you are willing to take and how much money you will invest. When answering this question, you will also need to consider your current level of knowledge and experience in the market, so that you don’t take on too much risk.

Keep in mind that having so much money at stake can sometimes lead to impulsive or poor decisions if not managed carefully, so it’s important to have a clear trading plan to avoid these pitfalls. Now let’s look at how you can develop a profitable trading plan.

How Do You Develop an Effective Trading Plan?

When we trade, we want to do so with the highest probability of success. With this in mind, and knowing that, as humans, we can become very emotional, you need to develop a set of rules that are measurable, logical and, most importantly, repeatable, as this will help to define the type of trader you become. I am sorry to say that relying on intuition or ‘gut feeling’ is not one of those repeatable rules.

The rules have to be consistent in their application rather than subjective. The more subjectivity, the more your emotions play with your trading decisions and, consequently, affect the outcome. Trade sizes and risk management strategies should be pre-planned, not decided on the spot, to ensure discipline and consistency.

On the other hand, a well-developed trading plan provides a systematic approach that helps you overcome subjectivity and protect your capital. Risk management rules are the most critical component of a trading plan, as they protect your capital.

1. Portfolio Type

To begin with, the type of portfolio you select will determine the appropriate stocks to trade. It will also determine the goal of your portfolio, whether it’s growth or growth and income. When setting trading goals, make sure they are specific and measurable for your entire portfolio, not just for individual assets.

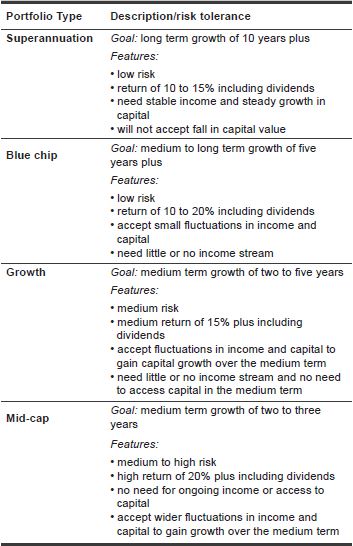

In the Table below, I have provided four different types of portfolios based on the level of risk. By no means are these the only portfolios you could construct, but they do indicate the volatility and potential return associated with each investment.

In identifying which portfolio is more suitable, remember that it’s important to consider the level of risk you’re willing to take because one thing is certain, the market will always be there, but you may not if you trade stocks that fall outside of your risk tolerance.

Portfolio Selection and Risk Click to see the image in full size

2. Investment Time Frame

Your trading plan must include an appropriate time frame that suits your lifestyle and your trading style. The key time frames in trading are:

- Intraday: hours within a day

- Short-term trader: 1 day – 12 weeks

- Medium-term trader: 3 -18 months

- Long-term trader: 18 months plus

When choosing a time frame, consider your time commitment and how much time you can realistically dedicate to trading activities each trading day. It's also important to define your time horizon for achieving your trading goals, as this will help guide your investment planning and strategy. Adhering to your trading day schedule is crucial for maintaining discipline and making necessary plan adjustments during market hours.

The question you have to ask yourself is do you want to trade over the short, medium, or long term? If you lead a busy lifestyle, I recommend you select medium to long term. Attempting to trade short term when you lead a busy lifestyle is very risky if you do not have the required time.

You may be surprised to learn that your profitability doesn’t come down to trading more frequently as is common with day traders. Trading is about figuring out what works best for you because, at the end of the day, trading is about creating a lifestyle not making it your lifestyle. Without clear boundaries, trading can become the exact opposite of your intended balanced lifestyle.

3. How Does Your Trading Strategy Support Your Reason to Trade

In formulating your trading strategy, you need to document the analysis you undertake from both a technical analysis and a fundamental analysis perspective to support your reason to trade. When analysing the fundamentals of a stock, you need to consider the dividend yield, earnings per share and the price-earnings ratio at a minimum.

From a technical analysis perspective, you would analyse the medium and long-term market trends to determine where the stock is and where it has been to identify where it is likely to go. You also need to consider the liquidity and volatility of the stock, as well as the number of shares traded per day.

You would also analyse the support and resistance levels and any patterns that may unfold on a bar or candlestick chart, as well as apply technical indicators to identify which tools work best on the stock. It is important to define specific entry criteria for your trades, using objective conditions such as technical patterns, indicators, or price action to ensure consistency in identifying optimal entry points.

Your personal qualities and characteristics, such as discipline, patience, and emotional control, will shape your overall trading approach and influence how effectively you implement your strategy.

It’s a good idea to back-test your trading strategy, so you become more familiar with the stock and how it’s likely to unfold once you place real money into a trade. As part of this process, pay close attention to position sizing and establish clear position sizing rules to manage risk and ensure consistent capital allocation across different trades.

Once you complete your analysis, you will be able to document your trading rules. Continuous education is necessary to stay informed about market news, economic events, and new trading techniques.

Trading rules

When trading over the longer term, your actual entry and exit points, while important, are not critical to your analysis, as we are expecting the trade to last around two to three years. This also applies when trading over the medium term, as we are expecting the trade to last from around three to 18 months. This means entering or exiting a trade a few days or even weeks late will generally make very little difference to your overall profitability.

When trading over the short term or day trading, your entry and exit points are critical, which is why it’s important to analyse both the weekly and the daily chart to ensure you are trading with the trend. Overcomplicating your trading plan can lead to missed trades due to hesitation or analysis paralysis, so keeping your rules clear and simple is essential to avoid missing valuable opportunities in volatile markets.

When determining your trading rules, you need to phrase each one to elicit a yes/no answer. As you are buying a stock that is trending up, your entry signal would read like this:

Buy: Has the stock formed two consecutive closes above a downtrend line (if trading on a weekly chart, for example)?

When setting your exit rules, you need to set an initial stop loss (which we discuss in more detail shortly) in the event the trade turns sour after you enter, as well as an exit rule for when the stock is in profit. Predefined strategies for exiting trades should include setting targets for taking profits and/or partial profits, and considering market conditions or news events.

Managing open positions involves adjusting stop-loss orders or taking profits as needed to lock in gains or cut losses. Tools like price alerts or automated orders can help remove emotion from trading decisions and ensure you stick to your trading plan.

Sell: Has the stock traded ‘x’ per cent below my buy price or has the stock formed two consecutive closes below an uptrend line (if trading on a weekly chart, for example)?

Now let’s consider how you can manage your risk before you enter a trade.

4. Money Management

This area of your trading plan is one of the most important aspects to consider. You must determine your position size or how much you are going to invest in each trade to determine your risk per trade. It is essential to consider your total available capital, including how open positions and any withdrawals may impact the funds you can access for new trades. As I share in my golden rules for investing, you should never invest more than 20 per cent of your total capital in any one stock.

The amount you invest is also relative to the number of stocks you hold. For example, if you decide to hold between 8 and 12 stocks, you would invest between 12 and 8 per cent (respectively) of your total capital in any one stock.

Let’s say your total capital is $100,000 and you decide you want to hold eight stocks in your portfolio, the maximum you can invest in any one stock is 12 per cent or $12,000 of your total capital.

Professional traders carefully assess their available capital and potential losses before entering any trade. Once you decide on the amount to invest in each trade, you need to look at the actual dollar amount and ask yourself, honestly, ‘Am I comfortable risking that much money?’ Having clear position sizing rules is crucial for consistent risk management, and position sizing should be planned in advance to align with your overall trading strategy.

If you are comfortable, the next step is to calculate your stop loss for the trade. Additionally, tracking your win rate is important to evaluate your trading performance and the effectiveness of your strategy over time.

Calculating Your Stop Loss

You need to determine your stop loss before you trade because it’s usually too late to do this when the stock is falling, simply because your money is on the line, and most people make emotional rather than rational decisions. It’s also hard to admit, once you enter a trade, that you have made a mistake in your analysis and even harder to be objective when you’re losing money.

Setting stop losses can be challenging, as you need to be close enough to your buy price to ensure you do not lose more than 2 per cent of your total capital, yet far enough away that the stock has room to move in case it falls after you buy into it.

Depending on the volatility of the stock this is usually 10 to 15 per cent below your buy price, as this allows for minor fluctuations in price as the stock settles into the trend. Failing to set appropriate stop losses can expose you to higher risks and significant losses, especially if you end up risking more than 2% of your trading capital on a single trade.

Setting a stop loss too tight (say 5 per cent below your buy price) leaves very little room for the stock to move and will decrease your probability of a winning trade. Alternatively, you can set the stop loss at a price point where you know with a high probability that you may be wrong in your analysis.

That said, for day traders, your stop loss is generally set a lot tighter as the risk-reward ratio is different to those who trade over the medium to longer term. When calculating a stop loss, you need to use the most recent price available and calculate it before you enter a trade. After doing this, you may find that you don’t want to buy the stock if the risk is too high.

Once you calculate your stop loss, you need to enter this information into your trading plan.

5. Notes and Trading Psychology

In this area of your trading plan, which acts as a trading journal, you would make notes about why you are taking the trade. It is a good idea to get into the habit of documenting this information, as it acts as a valuable learning tool when a trade turns bad.

You may also want to document why you have sold the stock when the time arises, which helps with analysing and managing your trading performance. Regularly reviewing your past trades is essential for identifying patterns, improving your strategies, and avoiding recurring mistakes.

You also need to document your trading psychology rules before entering a trade, as well as your frame of mind at the time of the trade. For example, you may state that you never make decisions while the market is open or that you will never trade if you feel anxious or under stress. Significant wins or losses can often lead to poor decision-making, so it is important to stick to your pre-planned strategies to avoid emotional reactions.

New traders often face unique challenges, such as testing their tolerance to risk and managing time, and can benefit greatly from learning from experienced traders who can provide valuable insights and help avoid common pitfalls. You can write whatever trading rules are most applicable to you because everyone is different.

A trading plan should be updated outside of trading hours to avoid emotional decision-making.

Now that you are clear on the five steps to developing an effective trading plan, let’s consider the importance of managing your trades.

Managing Your Trade

Your exposure to risk in the stock market is greatest when you first purchase a stock simply because you pay brokerage, which means you are at a loss the moment you buy. While your detailed trading plan may indicate there is a high probability you will succeed, there is no certainty you will make a profit. It is only when the stock begins to rise in price that these risks diminish.

Therefore, once you enter a trade, you need to manage your risk. Managing your trading activities and consistently monitoring your open positions throughout the trading day is essential to ensure you are prepared to make timely adjustments and protect your capital. Establishing a daily routine, such as managing your trading environment and your mindset, and reviewing your trading plan, as this helps you prepare mentally and strategically for each trading day.

Likewise, if you stick to your trading plan, you’ll have a greater chance of making rational decisions rather than reactive decisions. Unless a stock tells you to sell by triggering one of your exit signals, do not sell. I promise you, that if you follow your trading plan and apply solid risk management techniques, you won’t fall into the trap of becoming an average trader, which means you will be far more profitable and successful in the long run. You will also learn to enjoy your trading journey.

Why You Need a Trading Plan Every Time You Trade

Although multiple traders may use the same rules, invariably, each trader will place their own interpretation and personal bias into their trading, with the potential outcome being very different for each individual. This statement is fundamental to understanding how markets move and why there is always an opportunity to profit. The simple logic behind this is that our beliefs, fears and greed influence the decisions we make and the type of trader we become.

That’s why having a trading plan is essential, as it helps to formalise your thoughts while you analyse whether the stocks you select align with the overall goal of your portfolio. The details of your trading activity that you include in your trading plan also help you to manage your trades and the potential risks. As you develop your knowledge and skills over time, you’ll be able to adjust your trading strategy and update your trading plan as market conditions and your financial situation or goals change.

The reality is that developing and testing a trading plan has the power to put you in the top 10 per cent of successful traders who consistently take profits from the stock market. Traders who win consistently treat trading as a business, relying on a well-developed plan and a disciplined approach to avoid impulsive decisions and achieve ongoing success. But it will require you to be disciplined and to have the necessary knowledge, skills and experience to be profitable in all market conditions.

- Timing the Stock Market - Debunking the Myths

- Protect Your Portfolio From a Stock Market Correction

- A Practical Guide to Dividend Reinvestment Plans

In my award-winning book, ‘Accelerate Your Wealth: It’s Your Money, Your Choice', I present a comprehensive roadmap that empowers you to increase your chances of success in the stock market. It is packed with some simple but powerful strategies to ensure you trade the stock market confidently and profitably.

To keep track of these emerging trends, tune into our Hot Stock Tips videos and latest news. Each video features market analysis, trading psychology insights, and updates on current ASX opportunities, which are all designed to help investors succeed regardless of market conditions.

Whether you’re a beginner exploring the Stock Market for Beginners or an active trader looking to refine your expertise, you’ll gain world-class support and proven methodologies to build long-term success.

To find out more about our trusted Trading courses or learn more About Wealth Within, visit our website and explore how thousands of Australians have already built profitable, sustainable trading careers. You can also gain insights into the success of our graduates by accessing their reviews and testimonials.

FAQs

Why is conducting market research important when developing a trading plan?

Conducting thorough market research is the cornerstone of building a solid trading plan. Before you start trading, it’s essential to understand the financial markets, including overall market conditions, industry performance, and broader economic cycles.

A well-researched trading plan helps you identify profitable trading opportunities while avoiding common mistakes that many traders make due to poor planning or emotion-based decisions. By understanding price movements, market trends, and long-term patterns, you can develop a strategy-based trading approach aligned with your financial goals and risk tolerance.

How does market research improve trading performance and consistency?

Market research gives traders the knowledge required for successful trading. Instead of relying on guesswork, it allows you to make confident, informed trading decisions.

A successful trading plan integrates continuous learning through research and analysing market conditions, staying up-to-date with global events, and monitoring market trends that affect entry and exit timing. By treating trading as a business and not a game, you can win consistently, improve trading performance, and make rational, data-driven decisions rather than emotional ones.

What are the key elements of market research in a solid trading plan?

A solid trading plan could also include research on:

- Current and projected market trends and economic indicators

- Industry and sector analysis

- The behaviour of different financial markets such as equities, forex, or commodities

- Historical price movements and the forces driving them

By incorporating this research into your trading plan, you can adapt your trading strategy and align it with your trading style (for example, day trading, swing trading, or position trading) while maintaining discipline and focus on your trading goals.