How Can a Beginner Invest in Shares?

By Dale Gillham

There is no doubt that investing in shares is a fantastic way to grow your wealth, but when it comes to beginners, it's important not to get caught up in the hype and follow the herd.

If you have been doing some research, you will likely have come across the statistic that 90 per cent of all traders either lose some or all of their money. Not the best outcome when your goal is to accumulate wealth. That's why I always say if you want to learn what the 10 per cent of successful traders do, find out what the 90 per cent do and don’t do it.

As a starting point in your journey, I have listed my top 10 tips to ensure you succeed when investing in shares as a beginner. I also take the time to dispel many of the myths that hold individuals back from achieving long-term wealth in the stock market.

Tip #1: Take time to educate yourself

It is a well-known fact that wealth is the transfer of money from the uneducated to the educated, which is very common in the stock market, especially for those starting out. That’s why it’s important for beginners wanting to invest in shares to gain a quality education, so they don't become one of the 90% of traders who fail.

And I don’t mean surfing the internet for free information, as this is likely to confuse you and lead you down a long winding path. Anyone who believes they will make a lot of money quickly based on sparse education is on the fast track to going broke.

If you are truly serious about the opportunity of growing your wealth over time (why else would you be looking at the stock market), your first investment should always be to educate yourself. The bottom line is that a proper education will ensure you win more than you lose.

You can learn more about how to buy ASX shares and how to invest in shares with little money to support you in taking the next steps. But before you do that, I encourage you to continue reading, as what I share will change how you view the stock market, and provide some insights into how you can become very profitable as a trader.

Tip #2: Don’t follow the herd

Many investors react to market conditions stampeding up the mountain when the market is rising and sliding down just as fast when the market is falling. Unfortunately, this mentality is proliferated by the daily market reviews and sentiments expressed in the media. So, what is it that drives us to follow the herd, particularly in the stock market?

Primarily it’s the ability to avoid feeling remorse in the event their decisions prove to be incorrect. Herd mentality also reduces the time required to properly analyse an investment decision based on the belief that if everyone else is buying, someone else must have already done the required analysis.

Investors who follow the herd would rather purchase a stock that others are also buying to seek comfort in the knowledge that they are not alone in their decision-making. It also allows them to rationalise their decision when a stock starts to fall since everyone else thought so highly of it, that it makes sense that they did too.

Based on experience, it is far better to take a contrarian view to investing, which is supported by Warren Buffett, who is well known for saying: ‘It is better to be fearful when others are greedy and greedy when others are fearful.’

So, how do you restrain yourself from following the herd and reacting to the emotions of fear and greed? You need to develop a written plan that clearly outlines the intentions of why you want to invest in shares and what you hope to achieve. If I gave you a dart to throw, your first question would most likely be ‘at what?’ When we don’t have a plan, we often live in the hope that we won’t suffer the consequences of our actions. But this is futile and a complete waste of time.

When we know what we are aiming for, we have a much higher chance of success. A written plan provides you with the roadmap you need to achieve your financial goals in the stock market so that you hit the target every time.

Tip #3: Why buy and hold is not the answer

One of the most perpetuated myths in the financial industry is that you should buy and hold over the long term. The reason most of us hear these words is because the industry cannot time the market, their funds are too large to manoeuvre with any speed.

Consequently, the public is cautioned through advertising slogans about the perils of market timing. But accepting that time in the market is more important than timing the market is the greatest downfall of anyone wanting to beat the market average.

Unfortunately, many investors who adopt this approach achieve very mediocre returns, at best, simply because all the gains they achieve in a bullish market are decimated when the market falls away.

In my experience, taking a more active approach (which I outline in more detail in the tips that follow) will allow you to participate when the market is rising and to sit on the sidelines when the market is moving sideways or down.

Tip #4: Buy only top-quality shares

The top 50 shares by market capitalisation (also known as blue chip shares) achieved their status for one reason – they are the best-performing stocks in the market. Therefore, it makes sense to stick with a good thing.

But too many mistakenly believe that blue chips are slow in generating returns and would prefer to take higher risks by investing in speculative or penny dreadfuls.

Contrary to popular belief, if you invest in top-quality shares and take a low-risk methodical approach to investing, nine times out of ten, you will achieve far higher returns than trying to pick the next boom stock or investing in penny dreadfuls.

That’s because it’s not how much you make on any one investment that makes you wealthy, it’s how much you do not lose over time.

Tip #5: Diversify but not too much

We have all heard the saying ‘don’t put all your eggs in one basket’. There’s a good reason for this - if you put all your money in one investment and it turns sour, you stand to lose all your money. Given this, it makes sense to set up a well-diversified portfolio.

So how many stocks do you need to hold to create a well-diversified portfolio to achieve maximum diversification and to minimise your investment risk? In my experience, you only require between 5 and 12 stocks in a portfolio. Anything above this, and you are exposing yourself to market risk, which cannot be eliminated.

Many in the investment industry claim that you should over-diversify within asset classes. But this not only dilutes your investment returns, it also increases your overall risk because you require more time, knowledge and effort to manage your stocks. It also condemns you to invest in mediocrity.

Tip #6: Cheap doesn't mean a bargain

Unfortunately, many newcomers to the stock market mistakenly believe that buying cheap is the best way to achieve higher returns. But this not only costs you money, it also hinders your ability to generate profits because you are speculating that a cheap stock will perform better than a solid blue-chip stock.

I have lost count of the number of people who have told me they invested in a stock because it was cheap. When I asked why they bought a cheap stock the answer is always the same—I can buy more shares at $0.50 than I could if I bought a stock for $20.00. But the amount of shares you can buy is irrelevant to your potential profit. Let me explain.

When we buy shares, we do so to make a profit. If I have $1,000 to invest, I can purchase 2,000 shares at $0.50 or 50 shares at $20.00. If the shares rise by 10 per cent, do I make more money on the $1,000 invested in the $0.50 shares compared to the $20.00 shares?

The result is the same, although many would argue that the $0.50 stock only has to rise $0.05 to make a 10 per cent gain while the $20.00 stock has to rise by $2.00 to make the same gain. While this is true, you need to also consider the chances of each stock making a 10 per cent profit.

I dare say the $20.00 stock has more potential to make a 10 per cent gain than the $0.50 stock and is far less likely to fall dramatically in price. Indeed, in a downturn, a quality blue chip stock will fall less than a speculative one and will recover more quickly. The $20.00 stock is also more likely to pay a good dividend, which means you not only get capital growth but also income on your investment.

Anyone buying a stock that is cheap but still falling in value is gambling on a recovery at some stage. Unfortunately, buying cheap is fraught with danger and often a costly mistake.

In my experience, when investors buy cheap stocks trying to get a ‘good buy’, they usually end up saying ‘goodbye’ to their money. Remember, your aim should always be to buy quality stocks, not quantity because this is where you will get the greatest gains.

Tip #7: Trade well, not often

It seems that today, more than ever before, when I talk to people who want to learn how to trade, they tell me that their end goal is to ‘day trade’ for a living. When I ask what day trading means to them, I usually get a myriad of responses based on ignorance because, all too often, individuals fall prey to the myth that trading more often means they will make far more money. But, the opposite rings true.

This is because many are taught to trade using daily charts, which is like having your face planted up against a brick wall. You are unable to see the bigger picture of what is unfolding on a stock or in the market.

From experience, individuals who trade less, using weekly and monthly charts, make far more money and experience far less stress. Indeed, they have learnt how to trade to obtain a certain lifestyle as opposed to making trading their lifestyle.

Tip #8: Apply good management rules

A common misconception held by many starting out is that you only need to be armed with the knowledge of how to pick the best stocks, but this ignores the importance of knowing when to exit.

One of the most important rules in trading is to protect your capital in the event you are wrong in your analysis and the share price moves against you. Therefore, before you enter a trade, you must apply a stop loss, which is simply a price point where you sell a stock to preserve capital if the trade turns against you. Depending on the volatility of the stock, I recommend you use a stop loss of 10 to 15 per cent.

It’s also important to manage your risk when investing in shares. From experience, I can say that if you follow my golden rules for investing, you will reduce your risk and achieve greater returns than most:

- Always take the same amount of time researching your options to ensure you are protecting your capital before you enter the market

- Always aim to have between 5 and 12 stocks in your portfolio

- Never invest more than 20 per cent of your total capital in any one stock

- Only ever invest 10 per cent of your available capital to trade short-term highly leveraged markets and allocate the remaining 90 per cent to trading a medium to long-term portfolio.

Tip #9: Don’t dollar-cost average

A concept that has dominated the financial industry for decades is the notion of dollar cost averaging. According to industry experts, dollar cost averaging can reduce the risk of investing in volatile markets and helps to avoid the so-called pitfalls associated with timing your entry into the market.

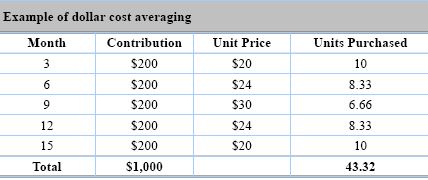

The concept involves depositing a fixed dollar amount into an investment at regular intervals over a period, regardless of whether the market is moving up or down to average the price at which you purchase the asset. Let’s see how it works.

As shown in the table below, let’s say you invest $200 every three months into a unitised fund that initially had a unit price of $20. Over fifteen months, the market rises and then falls (causing the unit price to drop to its original value).

In this instance, while we invested $1,000 over 15 months, we are now at a loss because we only have 43.32 units at $20, which equates to $866.60. Imagine if you invested in a fund that continued to trend down for years. I don’t need to say anymore!

Click to see the image in full-size

The real emphasis of this strategy is the inability of the investor to time the market, so they are encouraged to invest smaller amounts over extended periods to take advantage of the fluctuations in the market.

However, this strategy is flawed because not only has the investor lost the opportunity to invest their money in assets that are rising in value, but they are also taking higher risks investing in assets that are potentially falling in value with no guarantee of making a profit, which is ludicrous in anyone’s book.

Tip #10: Use leveraging wisely

Unfortunately, the poor use of leveraging (borrowed capital) leads those who are unskilled to trade on emotion, chasing the market in the hope of attaining riches. Ignorance and overconfidence abound, particularly when trading highly leveraged markets such as Forex, as people mistakenly believe they can handle the fluctuating extremes that these markets present.

The sad reality is that, for most, trading highly leveraged instruments is like giving the car keys to a ten-year-old and telling them to go for a drive.

The truth of the matter is that unless you have proven to yourself you can profitably trade stocks directly, you should never consider trading leveraged markets. If, once you have this experience, you are adamant that you want to trade leveraged markets, you should never invest all your available capital and never leverage beyond 50 per cent of your total portfolio.

So, there you have it, my 10 top share tips for how a beginner can start to invest in shares with confidence. Remember, when it comes to investing in the stock market, your best investment is in a quality education that guarantees you can competently and confidently trade in all market conditions.

If you want to discover more of my strategies to profitably trade the stock market including some of my trading rules, purchase my latest award-winning book, Accelerate Your Wealth, It's Your Money, Your Choice!