Investing in Stocks for Beginners: How To Guide

By Dale Gillham

When you start learning about investing in stocks, you’ll often hear about the Australian Securities Exchange (ASX), which is the central hub of Australia's stock market, where major public companies like Commonwealth Bank, BHP, Coles, and National Australia Bank are listed.

Investors can buy shares in these public companies through the ASX, typically by using a broker or an online trading platform. These companies are integral to the Australian economy, providing a strong foundation for understanding market movements and share prices.

This comprehensive guide from Wealth Within is designed specifically for new investors who want to start investing confidently. You’ll learn the key concepts of the share market, how to open a brokerage account, understand tax benefits, and make informed investment decisions to achieve your financial goals.

Introduction to Investing

Investing in the stock market is one of the most effective long‑term investment strategies for building wealth and achieving your financial goals. On the ASX, you can buy and sell shares of companies across multiple asset classes, including finance, resources, and technology, to name a few.

Before you start investing, it’s important to recognise that the share market comes with both opportunity and risk. Stock prices fluctuate based on market volatility, company performance, and broader economic conditions. Understanding these fluctuations and their tax implications is key to maintaining disciplined, profitable investing habits.

To begin your investment journey, you’ll need to open a brokerage account. You can choose between a full-service broker, who can offer tailored professional advice and help you make informed investment decisions, or an online broker, which allows you to manage your own trades at a lower cost.

Whichever option you choose, it’s wise to seek professional advice to ensure your investment strategy aligns with your financial situation, cash flow, and tolerance for how much risk you’re comfortable taking. Remember, every market participant is different, so your investment approach should reflect your unique needs and risk tolerance. Taking the time to understand the basics and get appropriate professional advice will help you start investing with confidence.

Investing in Shares or Stocks for Beginners: A Comprehensive Guide

If you’ve realised that investing in shares provides a long-term solution to building wealth, you have come to the right place.

With the ease of access to technology and information, there has been an explosion of individuals worldwide who have taken the bull by the horns and invested directly in the stock market. When it comes to investing in shares for beginners, however, their initial attraction is often based on a hot tip or because their friends were talking up the huge amount of money they could make from the stock market.

Unfortunately, the outcome for many of those who have invested this way has been one of disappointment because they have either lost some or all of their capital, given that they did not have the right tools to ensure their longevity in the stock market.

But this needn’t be the case if you educate yourself with some simple rules, which I outline in this comprehensive guide. I also provide you with a roadmap to help get you started.

Building your investing knowledge is crucial to making informed decisions and developing confidence in your investment journey.

Before we explore how to make money by investing in shares, also known as stocks, it’s essential to understand what a share is. To put it simply, a share represents ownership in a company. As such, when you invest in shares, you become a part-owner of that company.

This means you join many other shareholders who collectively own the company and share in its benefits, such as dividends and voting rights. It's also important to consider share value, which reflects the company's financial health and long-term growth potential, not just the current share price.

Owning shares means having a stake in the company’s success and the chance to share in its profits. Companies like National Australia Bank, BHP and Coles, which are all household names, are listed on the ASX. The Australian Securities Exchange (ASX) is also known as the stock market or stock exchange, and is where shares are freely bought and sold between individual investors. When you buy or sell shares, you are trading with other investors in the market, allowing ownership to transfer between parties.

In addition to individual stocks, you can also purchase other investment products, including Australian real estate investment trusts (A-REITs), listed infrastructure funds (LICs), listed managed funds and exchange-traded funds (ETFs) on the ASX. These vehicles invest in shares and other assets to provide diversification, and different investment strategies can be implemented through them.

How the stock market works

The best way to understand how the Australian market works is to look at it like an auction, where there are bidders, sellers, and an auctioneer facilitating the transaction.

The ASX is the auctioneer. If you have 5,000 people wanting to buy shares and 5,000 wanting to sell the same shares, the auctioneer will match the buyers and sellers to exchange the shares at a specified stock price. This is done via a third party known as a stockbroker licensed by the Australian Securities and Investments Commission to facilitate the transaction on your behalf.

The actual share price of the individual company is, therefore, determined by the forces of supply and demand, which is represented by the buying and selling activity for that company’s shares in the share market.

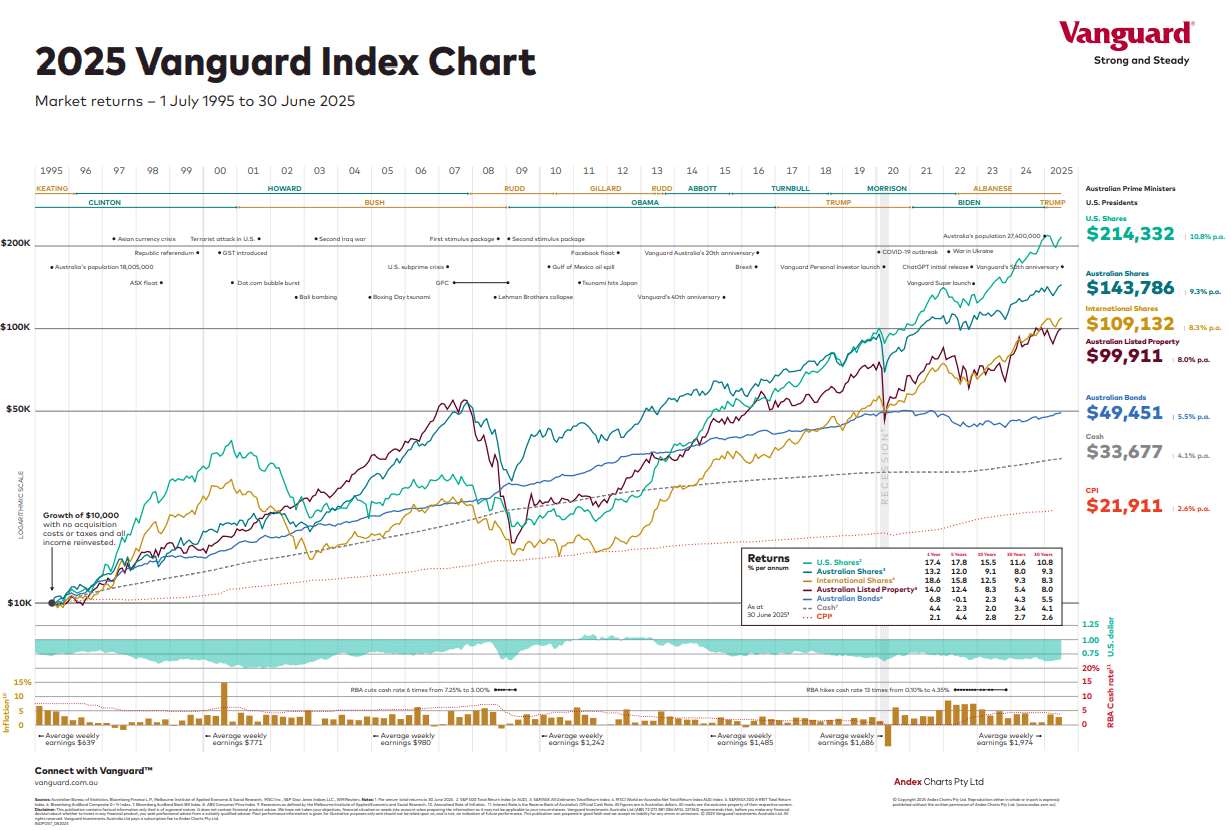

Historically, Australian shares have provided higher returns than other types of investment, such as cash and bonds. While there are risks involved, the potential rewards can be substantial.

As the 2025 Vanguard Index Chart shows, below, Australian shares have achieved an annual return of 9.3 per cent p.a. (excluding transaction costs) over the last 30 years to 30 June 2025 while Australian bonds have achieved a return of 5.5 per cent p.a. and cash a return of 4.1 per cent p.a. Transaction cost refers to the costs incurred when buying or selling shares, such as brokerage fees or the difference between the bid and ask prices.

This is despite the challenges of stock market crashes, a global pandemic, natural disasters, a succession of governments and the Global Financial Crisis (GFC). It’s important to remember that past performance is not a guarantee of future results.

2025 Vanguard Index Chart Click to enlarge image

While US shares have performed better than Australian shares, let me say from experience, as a beginner, you are better off focusing on stocks in the Australian market until you hone your skills. This is because when you invest in overseas markets, you have to contend with fluctuating exchange rates when settling transactions, which can affect your portfolio returns, particularly if the Australian dollar is appreciating. As a rule of thumb, I recommend beginners avoid investing in any international markets.

The key to investing well is to ensure you are buying assets that have growth potential because to achieve better-than-average returns, you need to concentrate on assets that are rising in value and increasing your wealth. Capital gains are made when you sell shares at a higher price than you purchased them for.

While trading the stock market comes with rewards, it’s also important to acknowledge that it also comes with risks. In fact, investing in shares is one of the few things you can do where you know from the outset you will lose money in real time. While many people tend to agree with this statement, the vast majority believe it won’t happen to them.

Shares are considered highly liquid compared to other assets like real estate, meaning you can sell them quickly to access extra money if needed.

Therefore, your long-term success in the Australian share market depends on how well you manage your risk. As Warren Buffett so eloquently states “Risk comes from not knowing what you are doing.” Before investing, it’s important to consider how much risk you are willing and able to take. The reality is that investing for beginners can be a very expensive exercise and, in some cases, more expensive than getting a quality education.

Understanding Shares

Shares represent a slice of ownership in a public company, giving you a stake in its future performance. When you invest in shares, you become a part-owner who can benefit from capital growth and regular income through dividends.

The value of your shares can fluctuate based on a range of factors, including the company’s earnings, industry trends, and broader economic conditions. This means that share prices can move up or down, sometimes quite rapidly, in response to news and market sentiment.

To help manage risk and smooth out returns, it’s important to build a diversified portfolio. This means spreading your investments across different companies, sectors, and even asset classes. One way to achieve diversification easily is through exchange traded funds (ETFs), which allow you to invest in a basket of shares with a single transaction. Whether you choose individual shares or ETFs, staying informed about industry trends and regularly reviewing your investment options can help you make smarter decisions in the stock market.

How Do I Make Money Investing in Stocks?

When you invest in shares, you can make money in one of two ways:

Capital gains

As the company grows and becomes more profitable, the value of your shares increases in value. If you sell your shares at a higher market price than what you paid for them, you will make a capital gain. However, if the share price falls below your initial purchase price, you will lose money if you sell your shares.

Dividends

You may also receive passive income in the form dividends, which are payments made to shareholders from the company's profits. Some dividends come with franking credits, which represent paid tax by the company and can reduce your tax liability. Typically, companies pay dividends at least twice a year, which is particularly attractive for those investors wanting to supplement their income or those in retirement who need additional cash flow. You can check the ASX website to identify if the stocks you’re buying are likely to pay a dividend.

While there is no definitive answer as to how much you need, as a beginner, you can start investing in shares from as little as $1,000, although you will need to start a savings plan so you can build up the number of stocks you hold.

If we assume an average annual return of 9.3 per cent p.a. (excluding transaction costs) based on the 2025 Vanguard Index Chart above, and assuming this average return continues, as you can see in the table below, with an initial investment of $1,000, you have more than doubled your investment over 10 years. Of course, the more you invest, the more your money compounds.

| Initial Investment | 2 Years | 5 Years | 10 Years |

| $1,000 | $1,204 | $1,589 | $2,525 |

| $5,000 | $6,018 | $7,946 | $12,627 |

| $10,000 | $12,036 | $15,892 | $25,254 |

An important factor to consider when determining your initial investment amount is the brokerage fee incurred on each transaction. To illustrate this, if you buy $1,000 worth of shares and pay $20 in brokerage fees when you buy and sell the stock, it has to rise by 4 per cent or $40 for you to break even.

Having a clear understanding of the costs associated with buying and selling stocks will help determine the appropriate investment amount to invest in each stock.

How Should a Beginner Start Investing in Stocks?

While investing for beginners in Australia can be an exciting and rewarding journey, it can result in overwhelm and fear, particularly if you don’t have the right strategy or process.

So, how should a beginner start investing and what do they need to know to succeed over the longer term?

When setting your investment goals, ask yourself key questions such as: What are you investing for? What is your time horizon? How much risk are you willing and able to accept? What is your target return? These questions help clarify your objectives and risk tolerance.

As you develop your trading plan, remember that changes in laws and regulations can impact your investment strategies, so stay informed and be ready to adapt.

When evaluating stocks, consider not just the share price but also the share value, as this reflects the company's financial health and long-term growth potential.

When reviewing stocks and making decisions, keep in mind that while past performance can inform your choices, it is not a guarantee of future results.

Building your knowledge and understanding the market is crucial. Make sure to learn about interest rates and how they impact investments, as well as other economic factors that influence the market.

Set clear investment goals

Before you start investing, it's important to understand why you're investing and what you expect to get out of it. No doubt, your investment goals will be influenced by many things, including your age and income, the size of your family, and your current wealth.

Some of the questions you need to ask yourself include:

- How long do I want to invest?

- How much money do I require to achieve my investment goals?

- What returns do I expect to get?

- What level of risk will I feel comfortable with?

- How much investment capital am I willing to risk for the opportunity to make higher returns?

- Do I require income, capital growth or both from my investments?

- How many stocks do I want to hold in my investment portfolio?

- How will I educate myself to ensure I succeed?

Knowledge is power

Once you have documented your goals, you need to commit to taking action—that is the action to acquire the knowledge that will enable you to invest in shares confidently and safely.

The more knowledge you have, the more confident you will feel because with confidence comes a higher comfort level for taking risks and discerning between the right and wrong types of investments.

If you seriously want to learn how to start investing in stocks and become consistently profitable, you need more knowledge than just knowing how to select a broker or how to place a trade (although this is important and is covered a little later).

You also need to know:

- How to build a diversified portfolio

- How to pick the best stocks to buy

- The best time to sell your stocks

- How to apply stop losses to manage the potential risks

While it is common for beginners to rely on free information to gain an education, this usually causes confusion and overwhelm due to the plethora of mixed messages. The reason is that information tells you about the 'what' without any process or real strategy to guide you. On the other hand, education gives you the 'how'—that is, the structure and processes to make confident decisions about how to invest in stocks and the knowledge to protect your capital.

That’s why I always encourage those new to the Australian share market, and even experienced traders who are having challenges, to study a quality trading course. The sooner you gain the knowledge and expertise, the more profitable you will become.

As you can see in the chart of the All Ordinaries Index below, despite the fluctuations, the stock market has continued to rise since 1982. Remember, the average return over the last 30 years was 9.3 per cent p.a. (excluding fees). Imagine what you could achieve if you had the knowledge and skills to actively trade the share market!

Performance of Australian Stock Market 1982 to 2025

It's also important to become confident in the basics of how the stock market works, which you can find in the education section on the ASX website.

Develop a trading plan for capital growth

If you want to increase your probability of success when investing in shares, it's also important to develop a trading plan that details your investment strategy, risk tolerance, entry and exit rules, and money management rules.

And, it's important to use a trading plan every time you buy a stock, as it will assist you in formalising your thoughts while you analyse whether the stock fits with the overall goal of a diversified share portfolio. You also need to ensure you stick to your plan and avoid making impulsive decisions based on emotions.

Start with paper trading

Before you commit to investing your capital, practice applying your trading strategy using a demo account or by paper trading. I know some of you will say that you can't test your trading strategy unless you put real money in the share market, but this is simply not true.

You wouldn't jump out of a perfectly good aircraft if you knew your parachute wasn't going to open. The same analogy applies - don't invest in shares unless you know your trading strategy is going to work on a consistent basis. Use this opportunity to identify any weaknesses in your strategy and refine your approach, as it will build your confidence and skill level.

Once you're ready to commit real money to buy stocks, start with a small amount that you can afford to lose. As you gain experience and confidence over time, you can gradually increase your position sizes.

There are over 2,000 companies listed on the ASX, so how do you know which stocks to concentrate on? The top 50 stocks by market capitalisation (also known as blue-chip stocks) achieved their status for one reason. They are the best-performing stocks on the market for the following reasons:

- They are highly liquid, in other words, there is a lot of buying and selling taking place in these stocks every day, which means even in the event of a dramatic stock market crash, you will be able to sell your stocks quickly and easily;

- The top stocks are often profitable businesses with some of the best managers, providing stability in the growth of the company and the stock price;

- The top stocks are purchased heavily by the institutions. Therefore, they're less likely to be affected by mass panic buying and selling;

- Reliable information about these stocks is much easier to obtain;

- The chances of any one of these companies going broke is very small; and

- Over ten years, the majority of these stocks will produce very good returns from capital gains and dividend income.

Large-cap vs small-cap stocks

Unfortunately, too many people mistakenly believe that large-cap, blue-chip stocks are slow in generating returns and would prefer to take higher risks by investing in small-cap stocks or speculative and penny dreadful stocks. But contrary to popular belief, if you invest in top-quality stocks and take a low-risk, methodical approach with your stock investments, nine times out of ten you will achieve far higher returns than trying to pick the next boom stock or by investing in speculative or penny dreadful stocks.

Let me say that it's not how much you make on any one investment that makes you wealthy; it's how much you do not lose over time. As such, buying quality blue-chip stocks allows you to gain knowledge and confidence while you're learning the mechanics of how to invest money in Australia as a beginner investor. Once you gain the knowledge and experience to consistently profit over time, you can expand your reach to the top 150 shares on the ASX.

Funding Your Account

Once you’ve opened your investment account, the next step is to fund it so you can start investing. Most brokers allow you to transfer money from your bank account directly into your trading account. Some may offer different types of accounts, such as a cash account for straightforward investing or a margin account if you’re considering borrowing to invest, though it’s important to understand the risks involved with leverage.

Before you buy your first shares, take the time to review the brokerage fees associated with your account.

These transaction costs can vary widely, from as little as $10 to $50 or more per trade, depending on the broker and the type of service you choose. Market volatility can also impact your investment experience, so consider setting up a regular investment plan. Investing a fixed amount at regular intervals can make it easier to stick to your investment strategy over time. However, remember, you should only invest in stocks that are rising in value and increasing your wealth.

How Can a Beginner Invest in Shares?

If you feel confident about how to invest in stocks in Australia and you want to start buying and selling shares, then these are the steps you can take to get started:

Step 1: Open a trading account

You will need to open a trading account and deposit cash with a stockbroker, who can facilitate you buying and selling shares on the ASX. It's recommended that you use the stockbroking arm through your bank; that way you don't have to set up another bank account. If your bank doesn't offer a brokering service, the ASX has a list of stockbrokers that operate in Australia.

There are two types of brokers. Depending on your comfort level, you can use an online broker to execute your trades in the stock market. This means you will be responsible for analysing individual stocks in your online trading account and deciding which ones to buy or sell. Alternatively, you can use a full-service broker who will provide you with investment advice and recommendations on the individual shares to buy and sell.

Brokerage feeswill vary depending on the broker you use but they can start as low as $3 for an online broker and up to 1 per cent or more for full-service broker. When deciding on a stockbroker, it's important to confirm that they offer competitive fees, a user-friendly platform, and quality customer support.

Step 2: Research stocks

Remember, before you invest in Australian shares, it's important to do your research. Look for quality companies that are profitable, well-managed, and have a good track record of growth. As I mentioned previously, it’s best to invest in the top 50 stocks while you build your confidence and knowledge level, as these are the most liquid stocks on the market.

Step 3: Place an order

Once you decide on the individual stocks you’re going to buy, you need to place an order with your stockbroker. Depending on the broker you choose, this is done either online or over the phone.

When placing an order, you'll need to specify the number of shares you want to buy and the market price you're willing to pay. It’s a good idea before you place a trade to understand how to buy and sell shares through a broker.

Step 4: Manage your investments and cash flow

Once you start investing, it's important to keep track of your investments every week and make any necessary adjustments to your trading strategy outside of hours. This allows you to remove the emotion from your investment decisions.

Before we finish up, let’s look at some of the challenges beginners contend with when investing in shares.

It’s absolutely possible to make money with share investing in Australia. However, unfortunately, those new to the stock market tend to make some critical mistakes that can end up costing them a significant amount of money. So you can avoid making these same mishaps, let’s take a brief look at what they entail.

Cheap doesn't always mean a good deal

While some of you may be attracted to companies outside the top 150, it's highly recommended that you avoid buying penny dreadful stocks or small-cap stocks. The reason is that while they may look cheap at 10 to 20 cents a share, a small company with a shaky track record can wipe out all of the gains you have achieved in your investment portfolio.

Furthermore, just because you can buy 5,000 shares at $0.20 each with your $1,000, doesn’t mean this is better value than purchasing 15 to 20 shares on a stock priced at $60. When it comes to making money in the stock market, it's not how many shares you own that counts, it's how much each share increases in value over time that's important.

Investing in shares when the stock price is falling

It’s important with share investing that you avoid buying shares when the stock price is falling. The share price may have fallen due to an announcement by the company of a profit downgrade or material change, which is damaging its chances of making money.

Before buying or selling a stock, I highly recommend you look at a price chart to gain an appreciation of the historical performance of the stock. If the share price has been declining over an extended period, the company would generally be regarded as a high-risk investment. Most brokers provide basic price charts that show a stock's history.

Don’t follow the herd

Many investors react to market conditions stampeding up the mountain when the market is rising and sliding down just as fast when the market is falling. Unfortunately, this mentality is proliferated by the daily market sentiment expressed in the news. So, what is it that drives us to follow the herd, particularly in the stock market?

Primarily, it’s the ability to avoid feeling remorse in the event your decisions prove to be incorrect. Herding also reduces the time required to properly analyse an investment decision based on the belief that if everyone else is buying, someone else must have already done the required analysis.

Investors who follow the herd would rather purchase a stock that others are also buying to seek comfort in the knowledge that they are not alone in their decision-making. It also allows them to rationalise their decision when a stock starts to fall, since everyone else thought so highly of it, it makes sense that they did too.

However, based on my experience, it is far better to take a contrarian view to investing, which is supported by Warren Buffett, who is well known for saying: ‘It is better to be fearful when others are greedy and greedy when others are fearful.’

Trade well, not often

It seems that today, more than ever before, when I talk to people who want to invest in shares, they tell me that their end goal is to ‘day trade’ for a living. When I ask what day trading means to them, I usually get a myriad of responses based on ignorance because, all too often, individuals fall prey to the myth that trading more often means they will make far more money.

This is because many are taught to invest in shares using daily charts, but this is like having your face planted up against a brick wall. You are unable to see the bigger picture of what is unfolding on a stock or in the market.

Based on more than 35 years of experience, I can guarantee you that individuals who trade less using weekly and monthly charts make far more money and experience far less stress. Why? Because they have learned how to trade to obtain a certain lifestyle as opposed to making trading their lifestyle.

Use leveraging wisely

Unfortunately, the poor use of leveraging (borrowed capital) leads those who are unskilled to invest on emotion, chasing the market in the hope of attaining riches. Ignorance and overconfidence abound, particularly when investing in highly leveraged markets such as Forex, as people mistakenly believe they can handle the fluctuating extremes that these markets present.

The sad reality is that, for most, investing in highly leveraged instruments is like giving the car keys to a ten-year-old and telling them to go for a drive.

The truth of the matter is that unless you have proven to yourself you can profitably invest in shares, you should never consider investing in leveraged markets. If you decide you want to invest using leverage after you gain the experience, you should only invest 10 per cent of your available capital in trading short-term, highly leveraged markets and allocate the remaining 90 per cent to trading a medium-to-long-term portfolio.

So, there you have it.

Tax Implications

Investing in shares comes with important tax implications that every investor should understand. When you sell shares for a profit, you may be liable for capital gains tax (CGT), which is calculated based on the difference between your buy and sell prices and how long you held the investment. Holding shares for more than 12 months can entitle you to a CGT discount, while selling shares within a year may result in a higher tax rate.

There are also potential tax benefits to consider, such as franking credits attached to dividends, which can reduce your overall tax liability. To make the most of these benefits and ensure you meet your obligations, it’s essential to keep detailed records of all your investments, including dates, prices, and quantities for every buy and sell transaction.

Because tax rules can be complex and change over time, it’s a good idea to seek professional advice from a qualified tax advisor. This will help you understand the tax implications of your investment decisions, maximise your capital gains, and ensure you’re taking advantage of all available tax benefits when investing in shares.

Investing Knowledge - How to Achieve Your Financial Goals

Learning how to invest in stocks can be a great way to achieve your financial goals and build wealth over the long term. By following the steps outlined in this guide, you can start your investing journey with confidence knowing that with the right knowledge and skills, you can be consistently profitable over the long term.

To learn the strategies to confidently trade the stock market, watch the Australian Stock Market Show, which is streamed live every Tuesday night from 7- 8 p.m. We teach you how to avoid the common mistakes most people make with stock investing, so you take less risk and increase your probability of making a profit.

You can also learn more about the success of our clients who have completed our trading courses by viewing their reviews and testimonials. Discover how you can begin your journey with expert guidance from Wealth Within, even if you're a complete beginner or a seasoned trader wanting to improve your profitability.

Dale Gillham is one of Australia's most respected analysts with over 35 years of experience working in the investment industry, including banking, financial planning, share market education and professional trading. He is the best-selling author of multiple books and is passionate about ensuring clients receive the highest level of education in the stock market with Australia's most comprehensive share trading education course.