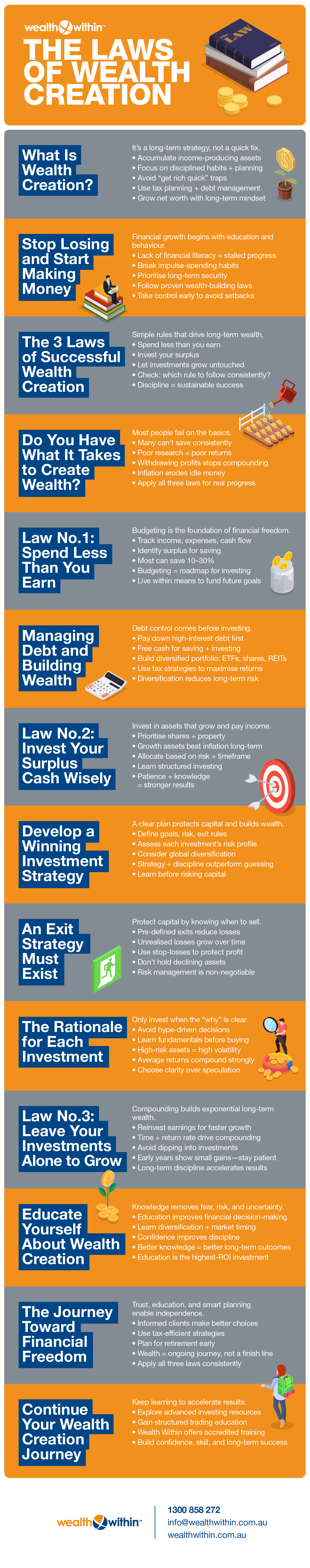

The Laws of Wealth Creation

By Dale Gillham

Achieving financial independence or creating wealth is a goal many people share, yet few achieve it. For most, the reason is not a lack of opportunity, but a lack of knowledge or confidence about wealth creation and how to begin the journey. Fortunately, it doesn’t have to be this way.

Financial literacy is a fundamental skill that empowers individuals to understand wealth creation, make informed financial decisions, and navigate the complexities of investments and wealth-building strategies.

A successful wealth creation strategy is built on a simple philosophy: cut your losses short and let your profits run. However, many continue to invest in assets that depreciate in value instead of focusing on financial assets that can grow and generate income.

In this comprehensive guide, we’ll explore the three laws of wealth creation, outlining the core principles for building long‑term success, growing your investment portfolio, and achieving your financial goals.

What Is Wealth Creation?

According to the Free Dictionary, wealth creation is the accumulation of assets (especially those that generate income) over a long period. In practical terms, it involves making informed decisions when saving and investing your money to meet short, medium, and long‑term financial goals.

True wealth creation isn’t about chasing “get rich quick” schemes. It’s a disciplined, lifelong journey that requires patience, perseverance, and education. Wealth creation is a key component of personal finance, which encompasses not only investments but also tax planning, debt management, and ongoing education. By developing good financial habits, creating a solid financial plan, and maintaining a growth mindset, you can steadily increase your net worth, achieve financial independence, and secure your financial future.

Stop Losing and Start Making Money

Many spend years gaining formal education to earn a stable income, yet dedicate little time to learning how to grow and manage that income effectively. Without financial education, most people end up working harder and longer just to maintain their lifestyle, often living from pay cheque to pay cheque. Ensuring you have enough money to meet your needs and achieve your financial goals is essential for long-term security and confidence.

Impulse spending and a desire for instant gratification often derail even the best financial plans, leaving individuals unprepared for retirement. The good news? It’s never too late to take control of your wealth creation journey.

From experience, I’ve seen that most individuals overlook the laws of wealth creation, assuming they already understand them. But if you’re not actively building wealth and making your money work for you, you may be unknowingly sabotaging your own financial future.

The Three Laws of Successful Wealth Creation

The laws of wealth creation provide the foundation for achieving long‑term prosperity. They allow you to reduce losses, grow profits, and develop the discipline needed for sustained success.

The three core laws are:

- Spend less than you earn

- Invest your surplus wisely, and

- Leave your investments alone to grow

These three laws form the golden rule of wealth creation, emphasising that adhering to sound financial principles is essential for long-term success.

Ask yourself: which of these wealth creation principles do you follow consistently?

Do You Have What It Takes to Create Wealth?

In over 30 years working in the investment and stock market education industry, I’ve seen that most people never make it past the first law: spending less than they earn. Saving money is a critical step in building a strong financial foundation, as it enables you to achieve important goals like buying a home, repaying a mortgage early, or working towards financial freedom. Others who do invest their surplus often fail to do proper research or develop an effective investment strategy, leading to poor decisions and average returns.

Even when they do invest wisely, many cannot resist withdrawing earnings instead of allowing their investments to compound. Following these three laws is the fastest way to move from losing money to building wealth consistently.

If you do nothing, inflation will quietly erode the value of your money. But by acting now and applying these wealth creation principles, you can set yourself on the path to financial independence.

Law No.1: Spend Less Than You Earn

When people ask me the secret to creating wealth, they often expect a “magic formula” for quick riches. Instead, I ask: Do you have a budget? Tracking how you spend money is crucial to ensure you are living within your means and prioritising savings. This may not sound exciting, but a budget is your first step toward financial freedom.

What Is a Budget?

A budget is more than a spreadsheet, it’s the foundation of your financial plan. It outlines your income, expenses, and cash flow, and should specifically account for your living expenses as a key part of effective budgeting. This helps you identify how much you can save and invest. Without it, how would you know:

- How much are you really spending?

- How much can you save each month?

Through proper budgeting, I’ve rarely met anyone who couldn’t save at least 10% of their income. Many can save up to 30% while maintaining a comfortable lifestyle.

Budgeting is your roadmap to financial independence, ensuring you always have surplus cash to invest in financial assets that generate income and capital growth.

Managing Debt and Building Wealth

Managing debt is a crucial foundation for anyone serious about creating wealth and achieving financial freedom. High-interest debt, such as credit card debt or personal loans, can significantly impact your ability to save, invest, and build a secure financial future. That’s why a successful wealth creation journey begins with a clear-eyed approach to debt management, followed by a strategic plan for wealth growth.

Once high-interest debt is under control, you can shift your focus to building wealth through a diversified investment portfolio. Consider a range of asset classes, including managed funds, fixed interest investments, the stock market, real estate investment trusts (REITs), and exchange-traded funds (ETFs). Diversifying across different investment options helps reduce risk and increases your potential for long-term financial security and capital growth.

Don’t overlook the importance of a tax strategy within your wealth creation plan. Understanding the tax implications of different investment types can help you maximise returns and minimise unnecessary tax burdens, further accelerating your wealth growth.

Law No.2: Invest Your Surplus Cash Wisely

Once you free up capital through saving, the next step in your wealth creation journey is to invest intelligently. Successful investing starts with understanding that wise investments deliver both income and capital growth. Building an investment portfolio requires careful asset allocation tailored to your risk appetite, investment timeframe, and financial goals.

If an asset provides only one or the other, you’re leaving money on the table.

Shares and property are two asset classes that can generate both steady income and long‑term capital gains. These are considered growth assets, offering the potential for capital returns over time and helping to beat inflation. While these investments may carry more short‑term risk, the long‑term rewards far outweigh low‑return options like cash or bonds, especially if you acquire the right knowledge and skill to manage risk effectively. Understanding each investment type is crucial for effective portfolio diversification and aligning your strategy with your objectives.

If you’re serious about improving your results, consider learning how to profit from share trading through structured education and strategy. While some investors may focus on short-term gains, true wealth creation is achieved through long-term stability and a strategic financial plan.

Develop a Winning Investment Strategy

Given that you work hard for your money, it makes sense that you would invest the time and money learning how to trade stocks or invest in property to ensure your investments are profitable.

That means having a clear, structured investment strategy that reflects your goals, risk tolerance, and timeframe. It's also important to carefully assess the potential risks associated with each investment before making decisions.

Ask yourself:

- Are you investing for short‑term income or long‑term wealth creation?

- Do you have a defined exit strategy and rationale for each investment?

- Are you considering investment opportunities in global markets to diversify your portfolio and enhance growth potential?

Let’s explore both of these essentials in more detail.

An Exit Strategy Must Exist

Every successful investment portfolio includes a defined exit strategy to manage risk. Yet many investors overlook this, assuming the stock market or property values will always rise. The truth is, every asset fluctuates, and unrealised profits can quickly vanish.

The key is to know in advance when and how you’ll exit if an investment underperforms. Many mistakenly believe that they haven’t lost money until they sell a failing stock, but in reality, losses grow the longer you hold declining assets.

Example: The Impact of Ignoring Losses

Suppose you invest $1,000 each in five blue‑chip shares. Four rise by 20%, but one drops 20%. You earn $800 and lose $200, netting a $600 profit, which is a 12% return on $5,000 invested.

However, if you hold the losing stock until it falls 50%, your portfolio’s overall profit drops to just 6%. This demonstrates how quickly unrealised losses can erode total returns. Always use a stop‑loss strategy to protect your capital.

Minimising downside risk and knowing when to exit are cornerstones of an informed investment strategy.

The Rationale for Each Investment

Successful investors understand why they invest in a particular asset. During the dot‑com boom of the late 1990s, many people invested based on hype rather than fundamentals, assuming technology stocks could only go up. The result? Massive losses when the bubble burst.

Speculative markets like cryptocurrencies can produce similar emotional traps. Without understanding the underlying risks and fundamentals, investors are gambling, not investing.

Before committing money, analyse each investment opportunity carefully. If the risk is too high or the rationale unclear, opt for a more conservative approach; even an average‑yield investment can build wealth steadily when managed strategically.

Law No.3: Leave Your Investments Alone to Grow

The third law of wealth creation is to harness the power of compounding, which is what Einstein famously called the eighth wonder of the world. Compound interest plays a fundamental role in this process, as it accelerates wealth accumulation by allowing your earnings to generate returns on both the initial principal and the accumulated interest, leading to exponential financial growth over time.

When you reinvest your earnings (such as dividends, interest, or capital gains), those returns generate even more income over time. By leaving your investments alone to grow, you also create the potential for passive income, which can contribute significantly to financial independence and long-term wealth. Compounding is the secret behind exponential wealth creation, driven by two key factors:

- Time – The longer your investments stay untouched, the greater your returns.

- Rate of Return – A higher rate accelerates the compounding process, leading to faster capital growth.

The power of compounding

If you invest $10,000 and earn 10 per cent interest in the first year, you would make $1,000. If you reinvest the $1,000 on top of your original capital of $10,000, you now have $11,000 earning interest at 10 per cent. This means you would earn $1,100 in the second year, and the effective rate of return or yield (excluding fees) on your original capital of $10,000 is now earning 11 per cent. Imagine if you continued to compound your returns.

As you can see in the table below, if you continue to reinvest your capital and earnings over five years, you will earn an effective yield (excluding fees) of 14.46 per cent on your original capital.

| Year | Capital Invested/Reinvested | Interest Rate | Earnings | Effective Rate of Return |

|---|---|---|---|---|

| 1 | $10,000 | 10% | $1,000 | 10% |

| 2 | $11,000 | 10% | $1,100 | 11% |

| 3 | $12,100 | 10% | $1,210 | 12.10% |

| 4 | $13,310 | 10% | $1,331 | 13.31% |

| 5 | $14,641 | 10% | $1,464 | 14.46% |

Once you embark on your investment journey, you should leave your capital alone to allow it to grow. Only when your investments generate income and growth equal to or better than what you earn from working in a 9 to 5 job should you consider using your investments or income for lifestyle purposes.

Sadly, many investors prefer short-term gratification and dip into their investments to buy a car, go on a holiday or do something unrelated to building wealth. If you do this, you should know that this will put you years behind in achieving your goals. This is because compounding produces only modest gains over the first few years. As demonstrated by the example above, the real effect of compounding is only seen when your capital and earnings are reinvested and left for longer periods, as they begin to grow much faster.

Educate Yourself About Wealth Creation

Knowledge is the cornerstone of successful wealth creation. Without understanding how to manage risk, time the stock market, or diversify your investment portfolio, fear and greed often take over, which leads to poor decisions.

Seeking professional business advisory services can provide tailored guidance to help you navigate complex financial decisions and optimise your wealth creation strategies.

An educated investor makes informed choices, understands market dynamics, and remains focused on long‑term financial success. Here’s why investing in your own knowledge is the best wealth‑building decision you can make:

1. Better Financial Decision‑Making

Education equips you with the tools to make confident, informed decisions about your money. As financial author Charles Givens said, “Knowledge overcomes the two enemies of prosperity: risk and fear.”

Understanding different investment strategies helps you optimise returns, avoid unnecessary losses, and stay on track with your financial goals.

2. Effective Risk Management

Educating yourself enables you to assess and manage investment risk. A sound risk management plan includes diversification, which means spreading your capital across different sectors or asset classes (like shares, property, and cash) to reduce exposure to market volatility.

Strategic diversification protects your portfolio from extreme events while smoothing out returns over time.

3. Increased Confidence and Control

Confidence is essential when building wealth. The more you learn about financial markets, the more capable you become at managing your own financial plan. With greater confidence comes improved discipline, a vital quality on any wealth creation journey.

4. Long‑Term Financial Success

Education fosters a growth mindset, empowering you to identify opportunities and navigate challenges along the way. As you expand your understanding of investment principles, you’ll make smarter choices that accelerate your capital growth and secure your financial future.

As a share trading educator, portfolio manager, and investor for over 30 years, I’ve seen countless success stories among those who commit to financial education. The more your understanding grows, the more confident and profitable you’ll become.

The Journey Toward Financial Freedom

Many professionals fear that educating clients will make them self‑sufficient. However, I’ve found the opposite to be true, the more informed my clients become, the more they value expert guidance. Education breeds trust, and trust leads to partnership in pursuing long‑term wealth creation.

As part of this journey, understanding tax-effective ways to grow and preserve wealth is essential, including strategies that leverage your marginal tax rate for optimal results. Utilising employer arrangements, such as making certain purchases with your pre-tax salary, can also be a smart component of a broader wealth creation plan. Additionally, retirement planning should be a key focus to ensure a comfortable and secure future.

Remember, creating wealth is a journey, not a destination. By following the three laws outlined in this guide: spend less than you earn, invest wisely, and let your capital compound, you’ll gain control over your finances and the confidence to make your money work for you.

Continue Your Wealth Creation Journey

If you found this article helpful, you may also enjoy reading:

For a deeper understanding, my award‑winning book Accelerate Your Wealth – It’s Your Money, Your Choice reveals powerful investment strategies to help you fast‑track your wealth creation goals.

Take charge of your financial future with real, structured education through Wealth Within, Australia’s only government-accredited share trading educator. Learn more About Wealth Within and explore the pathways that have helped thousands of Australians trade confidently and achieve lasting success.

Ready to stop guessing and start trading with skill? Join Australia’s most trusted trading educator and take the first step with the Short Course in Share Trading.

Dale Gillham is one of Australia’s most respected analysts, with over 30 years of experience in investment strategy, financial planning, share market education, and professional trading. As a best‑selling author, Dale is passionate about providing Australians with practical, education‑based tools to succeed in creating wealth and achieving lasting financial independence through Wealth Within’s comprehensive share trading courses.