Day Trading in Australia: What is Day Trading?

By Dale Gillham |

Nowadays, everyone wants to be a day trader, but what is day trading and does it live up to all the hype?

When I ask people what day trading means to them, I'm often met with a mix of confused responses based on a lack of knowledge and understanding. The challenge with day trading is that many have bought into the idea that buying and selling shares more frequently will make them a lot of money. But is this really true?

Introduction to day trading

While the concept of day trading is appealing, given it is promoted as a quick way to make money, it is not as simple as many people believe. Traders must be able to react quickly to market changes and make decisions, sometimes within a matter of minutes or even seconds. Day trading also requires a great deal of research and knowledge in order to make profitable trades. To be successful long term, you need to understand financial markets and the stocks that you are looking at investing in.

In this article, we share the reality of day trading and why you can make far more money if you learn to trade well rather than often. I also share a case study in which I outline a million-dollar mistake that will have you thinking twice about day trading and using daily charts to analyse the stock market, which is very common with day traders. So, let's get started.

What does it mean to be a day trader?

In simple terms, day trading is an active strategy involving buying and selling assets, such as stocks, currencies (also known as the Forex market or FX trading) and commodities to capitalise on short-term price fluctuations within a single day. A day trader typically spends most of their day watching the market to place multiple trades on the stock exchange in the hope of making a profit on the difference between the buying and selling price.

The objective of a day trader is to close out all of their positions before the market closes to reduce their exposure to market movements when it opens the next day. Closing out their positions at the end of the trading day also helps to avoid any holding costs they may incur overnight, particularly in leveraged markets where traders trade on to margin using borrowed funds.

How to day trade in Australia

If you decide to take up day trading, there are a few key considerations you need to take into account. In Australia, day traders must have their own trading account with an online broker. Most brokers will require you to open a margin account if you want to trade currencies, which allows you to borrow funds from your broker. That said, it is important to understand the risks associated with margin trading before entering this kind of trading.

Some day traders place trades with offshore brokers, believing they will receive better opportunities and access to larger markets. However, it is important to note that if any issues arise, there may be limited legal protection under Australian law.

Day trading in Australia also requires a sound strategy and an understanding of the financial markets, as it comes with a higher degree of risk and uncertainty. Traders need to be able to make quick decisions based on technical analysis, chart patterns, and other indicators. Day traders can use many strategies to identify trading opportunities, such as range trading, trend trading, or swing trading, which we discuss a little later. If you want to become a successful day trader, it's important to gain experience and acquire the necessary skills and knowledge so you don't put your capital at risk and you learn how to protect your profits.

What is the attraction to day trading?

Many people are attracted to day trading in Australia as a way to replace their income. They believe that to achieve their financial goals, they need to replace their 9-5 job with a day trading job, which is often spurred on by professionals, like brokers, who profit each time they trade.

There are dozens of websites promoting the hype and mania about the ease of becoming a day trader and the so-called get-rich-quick mentality that prevails. It's also common to see attention-grabbing promotions that make day trading seem like a profitable way to trade shares.

But is the claim about the potential profits you can make actually true?

Is day trading worth it?

It is widely acknowledged that 90 per cent of traders don't make money. In terms of day traders, however, it's estimated that well over 95 per cent ultimately lose some or all of their money. Unfortunately, many individuals continue to day trade despite their losses, hoping for a turnaround as they buy into the marketing hype.

You're probably asking why most traders fail when day trading. It's because the stock market is an emotional barometer, and when your money is on the line, your emotions are heightened. Fear and greed overtake logic and reason, particularly when the market is open.

Can you make money day trading?

While it is possible to make real money through day trading, unfortunately, most individuals lack the knowledge and skills to manage themselves and their trading effectively. This means they tend to experience more losses than wins because their emotions are amplified, which leads to poor decision-making. Additionally, many fail to approach the stock market with the appropriate level of respect, falsely believing that the market owes them something.

There is also a lack of awareness about the potential risks associated with day trading, and many individuals don't understand their risk tolerance. That's why it's important to recognise the connection between risk and knowledge. The more risk you take, the higher the level of knowledge required to manage the risk.

The major reason why day traders fail

Many day traders fail because they are taught to trade using daily charts, which limits their ability to see the bigger picture of what is unfolding on a stock or the market.

I was recently talking to a trader who had been day trading stocks for many years. He communicated that he watched the markets all day on multiple computer screens to make some quick profits. Now, you can imagine how stressful that would be. Given that he enquired about our trading courses, you would have to assume he was not making many profitable trades.

I said to him that, at a guess, if he added up all the hours in a week that he spent studying the market and buying and selling stocks and divided this into the profits he was making, he would get a better hourly rate working at McDonald's. He agreed. And the penny dropped.

Let me ask, would you prefer to trade more and make less, or trade less and make more? Hmm…I know which I would prefer. I can categorically say that individuals who trade less using weekly and monthly charts make far more money and experience less stress. On average, skilled investors typically make their profits from 10 to 12 trades a year with a return of 20 per cent or more.

Trading well is about creating a certain lifestyle rather than trading becoming your lifestyle. That's an important distinction and one I encourage you to ponder on.

Day trading strategies

Another reason why most day traders fail is because they use common technical indicators such as moving averages, relative strength index (RSI), and Bollinger Bands. While these tools can assist in analysing the market, they are often called lagging indicators as they only confirm a move after it has happened.

We teach our students to trade using leading technical indicators, such as Dow Theory, Gann Swing Theory (which is where the term swing traders come into play), Counter-Trend Theory and range trading, among other techniques. These techniques, known as classical technical analysis, help you to enter or exit trading opportunities much earlier, which means there is more profit in your back pocket.

While these strategies can be used to day trade, they also work very effectively when trading over the short, medium and long term.

Dow Theory

Dow Theory is a short to medium-term indicator that provides a trader with an opportunity to get into the market on short-term price movements with relatively minimal risk but with a higher probability of success and to get out of the market when it indicates there is weakness to protect capital and profits.

When day trading, you need to pay close attention to the trend you are analysing. While you want to trade with the longer-term trend, your goal is to enter and exit positions at the earliest sign of a change in trend, which means you are often taking higher risks, as the change in trend may not be confirmed. Therefore, when you take a position using Dow Theory, the trick is to avoid too much slippage when the price indicates it is moving in the direction of your entry or exit price. You also need to ensure you don't enter or exit too early so as to dramatically increase your risk.

Gann Swing Theory

Gann Swing Theory is a very simple technique that helps to dramatically increase your probability of success and reduce the level of risk with each trading opportunity. This is because swing charts provide a very simple visual aid to assist in determining the strength (often referred to as momentum trading) and direction of a stock (or market) in regard to price. While swing charts are best used when combined with other analysis tools, they can be used in isolation, which is a technique referred to as swing trading.

Because swing charts only represent the price movement of a stock, they filter out the noise commonly associated with bar charts. Therefore, swing charts make it easier for swing traders to recognise trends and the strength of a trend.

Counter-Trend Theory

Essentially, traders want to get into a trade at the first sign of a new uptrend forming so that they are in a position to profit for the duration of the uptrend. Just as importantly, they also want to exit a trade at the first sign that the uptrend has ceased, which is where Gann’s Counter Trend Theory comes into play.

A counter-trend move is a price correction opposite to the primary trend in either a confirmed or unconfirmed trend. In other words, a counter-trend is a movement in price in the opposite direction to the unconfirmed or prevailing (confirmed) trend.

We can also use volume to confirm a Gann counter trend, which is very effective for short-term trading. Using volume to confirm a counter-trend can reassure an investor that the market sentiment is with them and that the price of the stock should continue in the direction opposite to the counter-trend.

Understanding the risks of day trading

If you're still thinking about day trading, it's important to know the risks involved to increase your chances of success.

1. High probability of losses

By now, you would be aware that day trading is like walking on a tightrope without a safety net. Making poor choices when day trading or in highly leveraged markets can result in devastating losses. An interesting study on 1,600-day traders found that 97 per cent of those who engaged in day trading over 300 days experienced financial losses. This proves my point that day trading has an alarmingly low success rate. That's why you must acquire the necessary knowledge and skills to ensure you don't put your capital at risk.

2. High risk

Remember, day trading requires you to make quick decisions that can result in significant losses, especially if you struggle to manage the extreme fluctuations and market volatility that occur in short-term, highly leveraged markets. You're also unlikely to succeed without a trading plan that you have back-tested. Day trading is not for the faint-hearted, as it requires a significant amount of knowledge and experience to be profitable. If you don't possess these, it's highly recommended you stay away from day trading.

3. Stress and emotional pressure

Day trading is both mentally and emotionally demanding. Traders need to manage their stress and maintain a work-life balance. This is especially important if you're day trading while still at work. Remember, trading is about creating a lifestyle, not making it your lifestyle; therefore, don't take on unnecessary stresses in your life that could lead to losing your hard-earned money.

4. Time commitment

Day trading requires a significant amount of time to analyse market trends and execute trades, which can be challenging if you have limited time or other responsibilities. If you can't dedicate sufficient time to day trading, it may be more beneficial to focus on trading over the medium to long term. If your circumstances change in the future, and you acquire the necessary knowledge and skills to profit consistently, you may want to engage in short-term trading to supplement your income. If you choose to do this, I encourage you to follow my golden rules for investing.

5. Costs

The costs of day trading are determined by the broker and the specific product chosen, as well as the market being traded. It's important to be aware of the brokerage and fees that you will be charged and the impact of the bid and ask spread on trades (usually referred to as commission-free trades). These can reduce your profits and magnify your losses if not managed carefully. When selecting an online trading platform, it's a good idea to understand how the brokerage and other fees will apply.

To put the risks of day trading into perspective, let's look at a case study of someone trading a million-dollar portfolio.

Case study of a day trader

A few years ago, a client who had just commenced studying with Wealth Within shared how he had mixed results with his day trading strategy. What I am about to share with you changed the way he traded and his fortune. During an initial discussion, I asked him a simple question: 'When you enter a trade, how well do you see what's going on?'

Unfortunately, many struggle to answer this question, as most don't see what's right in front of them until it's too late. Remember, most day traders use daily charts to analyse the asset they are trading, which means they have a low success rate as they can't see the bigger picture of the trend unfolding.

This is one of the main reasons why the majority who attempt to day trade only last around six months before they drop out. Eventually, the market weeds out those who persist in making the same mistakes repeatedly.

The client had been trading a million-dollar portfolio and considered himself an experienced day trader as he had been doing it for many years but with mixed success, which was affecting his financial situation. He came to the conclusion that he needed to change the way he made trading decisions and start from the ground up. He had previously been using moving averages and other lagging indicators he had learned from different seminars and internet searches.

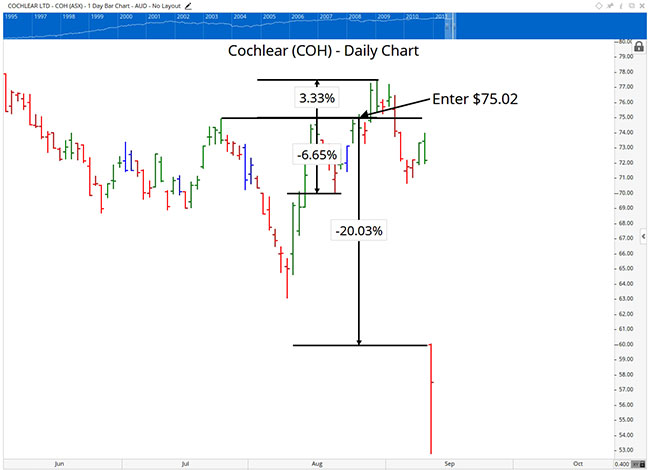

On his first day in our course, he sent me a chart of a trade he had taken. He wanted to know what he did wrong. It was a daily chart of Cochlear (COH). Figure 1, below, shows the period of time when he entered the trade at $75.02, as he had identified that this was an important resistance level. Before entering the trade, he had done one thing right, which was to set a stop loss; he was prepared to risk less than 7 per cent of his capital in the trade.

Figure 1 chart Click to see the image in full-size

Initially, the stock rose by around 3.3 per cent, as shown in Figure 2 below, before falling heavily (I have removed the analysis from the chart so it is easier to read).

As the stock fell away, the client was stopped out around 20 per cent below his buy price as the stock gapped down. So, on a position size of $100,000, he had just suffered a 20 per cent or $20,000 loss. Ouch! He also mentioned that he had been stopped out several other times, all with big losses, which explains why he was experiencing challenges with his financial situation.

The question isn't whether he should have set a tighter stop loss. The point is that he should never have been in the trade in the first place.

Figure 2 chart Click to see the image in full-size

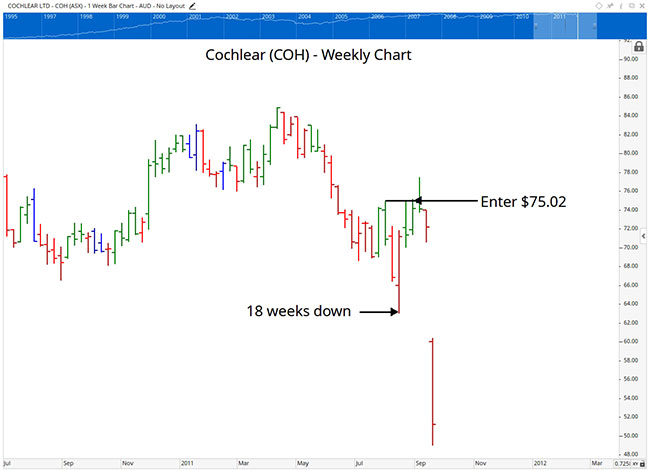

So, let's review what the client should have considered before entering the trade. Figure 3, below, shows the weekly chart of COH. When the client entered the stock on the daily chart, there was no entry on the weekly chart, as it had been falling for eighteen weeks just before his entry. This demonstrates how being too focused on the short term and not understanding the bigger picture can kill your opportunity to take millions from the market.

Figure 3 chart Click to see the image in full-size

The point is that, regardless of what you are trading or the intended timeframe, it is always important to look at the next larger timeframe to understand the landscape you are trading in. Furthermore, you need to ensure you have solid rules and analysis behind your decision to trade. This shows you understand the risk you are taking and when to enter or exit.

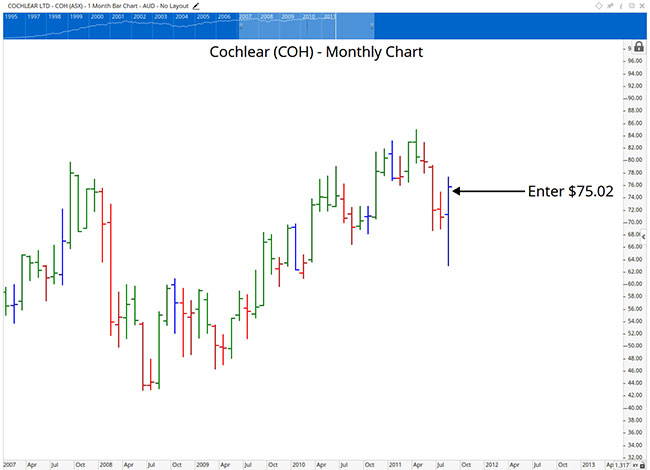

Looking at the monthly chart of COH, Figure 4, below, you can see that when the client entered the trade, the stock appeared to be reversing direction, as indicated by the outside (last) bar. In reality, however, the price was still technically falling in a downtrend, and there was no confirmation that the trend was changing, only speculation that it might, which, in my book, is gambling. This made what the client was doing very high risk.

Figure 4 chart Click to see the image in full-size

Had the client analysed the stock with the right knowledge, he would have found many reasons not to take the trade. It really does pay to know the terrain you are trading in before taking a trade. This means you are more likely to enter at a safer, lower-risk period of time, and you are, therefore, more likely to profit.

This case study has undoubtedly cemented the reality that day trading is a very high-risk strategy without the right knowledge and time commitment to ensure you succeed.

But just like this client, what if I could show you a smarter way to make a living from trading?

Becoming a successful trader

Unfortunately, not everyone is suited to being a successful day trader. When talking to people who want to day trade, what they really want is to become a full-time trader and replace their income from share trading.

While this is achievable, you need to combine a high level of knowledge and skill with experience, as this will allow you to become a skilled trader to assess the market you are trading more competently. Without this, your probability of being a successful trader over the longer term is very low.

You also require a solid trading plan that you have back-tested that confirms you have a high probability of making real money in the market you want to trade. The 90 per cent of traders who fail do so because they fail to plan. Being a successful trader also means being committed and having the right attitude.

The key to becoming a consistently profitable trader in the long-term

Investing is more than just applying a set of rules to enter or exit the market. When developing a trading strategy to trade financial markets, you need to understand:

- How to apply sound money management rules to manage your risk so you protect your capital each time you trade;

- How to correctly interpret price trends in the stock market and chart patterns in stock prices so you increase your profit potential;

- How to apply technical analysis and fundamental analysis in combination to create a more robust trading strategy;

- How to develop a profitable trading plan;

- When is the best time to enter and exit a trade;

- Your tolerance to risk and how this applies to the markets you want to trade;

- The investment timeframe you are trading and how this fits into your current lifestyle; and

- Why your knowledge and skill level are directly related to how successful you will be when trading over the short, medium, and long term.

Do you want to be in the top 10 per cent of successful traders?

In my experience, those who fail to achieve their goals in the market do so because they fail to commit the time and money to develop the right knowledge and skills. But there is an old saying that 'what a wise man does in the beginning a fool does in the end'.

Think about it. If you have only read a few books on investing or attended some weekend workshops, do you truly believe you have the knowledge and skill to day trade? Probably not, but unfortunately, many prefer to find out the hard way through the school of hard knocks.

As I always say, if you want to be in the top 10 per cent of successful traders who consistently make money, avoid following the strategies of the other 90 per cent who lose.

If you are serious about being part of the 10 per cent, we encourage you to read Dale's latest award-winning book, Accelerate Your Wealth – It’s Your Money, Your Choice. It is packed with simple yet powerful DIY investment strategies that will ensure you are profitably trading the stock market consistently.

You can also join us every Tuesday night from 7-8 p.m. on the Australian Stock Market Show, where we share how you can become a more profitable and successful trader.

Discover the success of our clients by reviewing their reviews and testimonials. You can achieve the same success with expert guidance from Wealth Within, even if you're a complete beginner or a seasoned trader wanting to improve your profitability.

Dale Gillham is one of Australia's most respected analysts with over 30 years of experience in the investment industry, including banking, financial planning, share market education and professional trading. He is the best-selling author of multiple books. He is passionate about ensuring clients receive the highest level of education and support in the stock market with Australia's only government-accredited course at the Diploma level.