5 Steps to Investing in the Share Market for Profit

By Janine Cox

Many perceive trading or investing in the share market to be more complex than it actually is or they choose a path that makes their journey more difficult than it needs to be. But this needn’t be the case.

In this article, I am going to share with you some concepts that will show you how to profit from investing in the share market, so you start achieving the results you want much sooner than you otherwise would. I will also introduce you to a simple but powerful trading technique that will allow you gain confidence in how you can consistently make money.

A myth about investing in the share market

For more than 18 years, I have spoken to many people who want to invest in shares so they can achieve financial independence and retire sooner, or because they want to create a passive income to live the lifestyle they prefer or to take control of their superannuation nest egg. However, what most people don't consider before they invest is that the amount of money you make is determined by the time and effort you are prepared to put in, and the quality of your education.

People often say that they would like to learn to invest in the share market but they’ve heard stories of individuals who have spent hours in front of their computer only to achieve mediocre returns. As a result, many end up handing over their investments to so called professionals believing it's all too hard.

The reason people give up on their dream of trading is because they have been misled into believing that they should rely on lagging indicators, such as moving averages, Bollinger bands and other computer generated indicators.

Unfortunately, while these techniques appeal to the masses, as they are perceived to be simple and easy, they don’t necessarily make you a lot of money. In fact, lagging indicators make brokers a lot of money because they whip saw you in and out of trades repeatedly, and overtime most traders fail to profit consistently.

Would it surprise you to know that the most skilled and successful traders do not trade this way? Instead, they use leading (or predictive) trend indicators that allow you to enter the share market at the earliest possible indication of a change in trend, which I share with you later in this article.

So let me ask you, when it comes to investing in the share market, do you want to trade more and make less or would you prefer to do the opposite with minimal risk if you had the right knowledge?

What is your education costing you?

When it comes to investing in the stock market, watching videos on YouTube or reading trading books may seem easy but in reality, all you really gain is a little bit of information and very little education. While learning this way is cheap, what does it really say about your mindset?

Think about it, if you want to make serious money investing in the share market, which is very achievable, why would you spend almost no money or a couple of hundred dollars on books believing this will guarantee your success.

Benjamin Franklin got it right when he said, “an investment in knowledge pays the best interest”.

Ask yourself, what is your education really costing you in terms of lost opportunity and lost profits? Let me give you an example.

If you invested $1,000 over 10 years with no extra contributions and achieved a 10 per cent compounded return, your return on investment (ROI) would be $2,707 or a 270 per cent return on your capital. But if you learnt how to achieve a 20 per cent compounded return, your ROI would be $7,268 or a 726 per cent return on your capital.

Now imagine you have $10,000 invested at a compounded return of 20 per cent - your capital would have grown to $72,683. No doubt, you are starting to get the picture of what it is really costing you not to get a solid education.

Now ask yourself, how serious am I about learning how to profit from investing in the share market and what am I prepared to do to learn the techniques that can double or triple the returns I am currently achieving?

Believe me when I say your education will cost you one way or another. But if you invest in yourself to learn how to increase your probability of success and, in turn, reduce the negative impact of your psychology, which very few traders place a high priority on, you will be able to achieve your financial goals.

5 steps to investing in the share market for profit

Now that you can appreciate the importance of what a lack of education is costing you, let's look at the five steps you need to follow to succeed at investing in the share market.

1. Get a quality education

Find someone to teach you who is qualified and has mastered the techniques. There is no substitute for a quality education, as it will dramatically increase your success and reduce the timeline required to achieve your goals. It is never too late to get the right education and remember, it’s just a decision. Once you’ve made it, you will find the time and money you require to achieve your goals.

2. Learn from experts

Observe what successful traders do and then apply the same techniques and processes. You need skills based, structured learning with exercises that allow you to demonstrate you understand and can apply the techniques appropriately. You must be able to check your answers, otherwise how do you know whether you have interpreted the application correctly?

3. Perfect practice makes perfect

As with anything you learn, repetition is the key. Get the application right and you will build your confidence. This is critical to your success. Prove you can consistently apply the trading techniques in any market condition using historical data. Most people get into the market without doing this first and end up testing their psychology before they trust what they are doing, which is to their detriment. This has a spiral effect on a trader’s psychology and costs them more than they realise.

4. Focus on the bigger picture

Stay away from daily charts when learning how to trade stocks. You are better off testing your knowledge and skill on weekly charts. With experience, you will find that you were wasting your time and money putting so much focus on daily charts, which unfortunately is where most people start out trading. A perfect example of this is the million dollar mistake a trader made using daily charts vs weekly charts to trade.

5. Get a trading mentor

You need a mentor or coach to ask questions and check your work as you gain the knowledge. This also acts as insurance, as it saves you time and money. A good mentor will help you to learn and trust the techniques, as well as cut out a lot of time from the learning process, while at the same time helping you to avoid costly mistakes. Think of the potential value that can bring, as your mentor will help you see what is missing in your trading.

So now let’s consider just one of a number of important trading rules all traders should have in their toolkit, unless they want to end up in the school of hard knocks.

One of the most profitable trading techniques you’ll ever learn

Trading is not about being right 100 per cent of the time - it’s about knowing your probability of success. You will always have losing and winning trades, but the goal is to determine a trading strategy that delivers with a high probability of success more winning trades.

One of the simplest and best trading techniques that is often overlooked by traders is Dow Theory. That's why we teach it in all of our courses, from the Trading Mentor Course to Australia's most comprehensive trading course, the Share Trading and Investment Course.

Dow Theory is a short to medium term indicator that allows you to enter and exit trades at the first sign of a change in trend or confirmation of a continuation of an existing trend, which is why it is considered a leading indicator. Put simply, this theory presents opportunities to get in or out of the market several times as the trend unfolds so you protect your profits.

When using Dow Theory to enter a trade, you would buy on confirmation of a higher trough, followed by price rising $0.01 above the previous peak, while an exit is confirmed by a lower peak followed by price falling $0.01 below the previous trough.

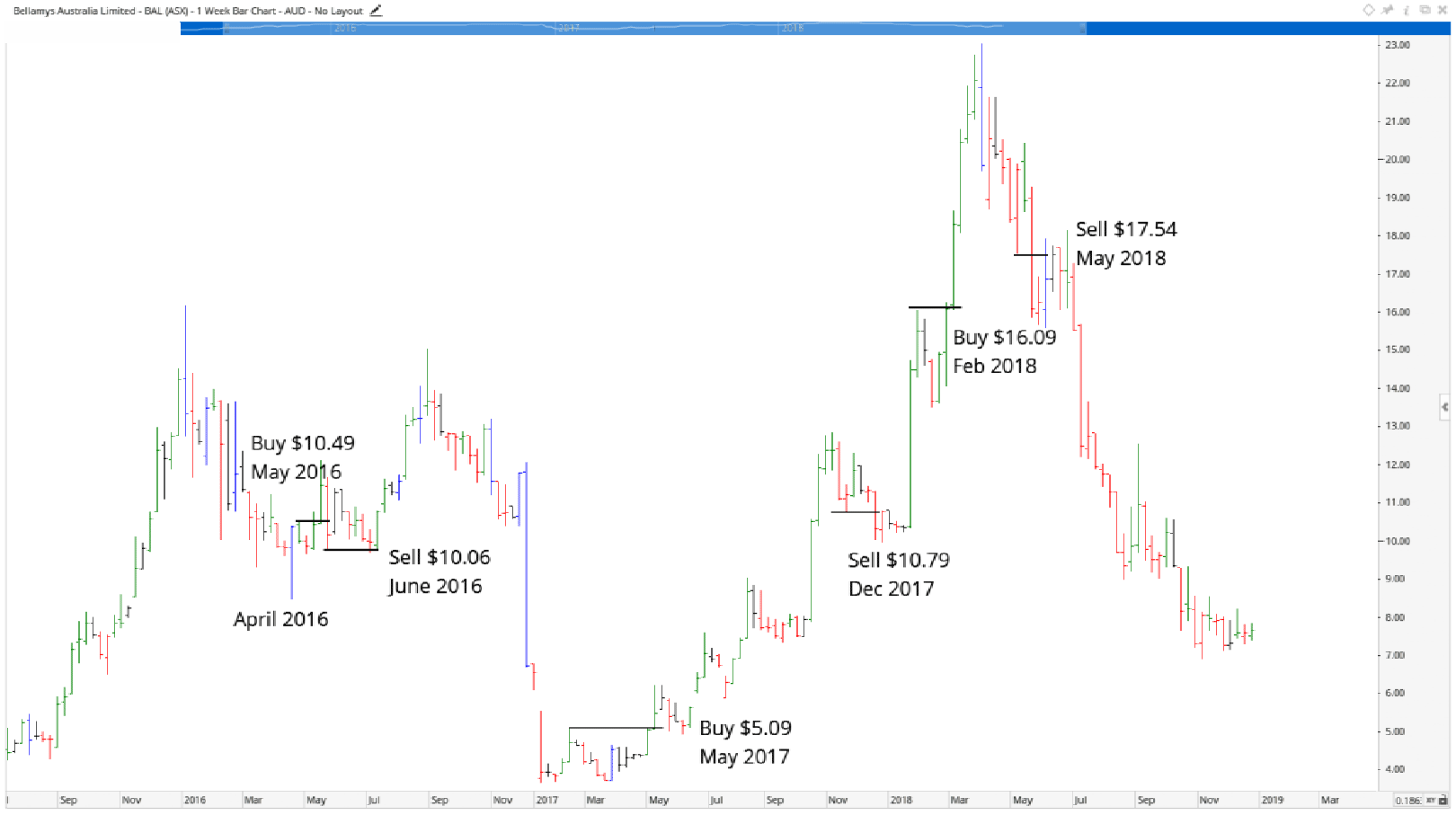

Let’s look at an example. On the weekly chart of Bellamy’s, below, you can see the stock formed a low in April 2016 before rising the following week. It then fell for one week prior to a Dow entry at $10.49 in May 2016. The stock then reversed shortly after to trigger an exit at $10.06 in June 2016. Although we exited at a loss of 7 per cent, it was only small and we were able to protect our capital given that the stock fell heavily following the exit.

Weekly Chart of Bellamy's Click to see the image in full size

The second entry occurred at $5.09 in May 2017 with the exit triggered at $10.79 in December 2018. Obviously, this trade was worth the wait given that it achieved a profit of around 112 per cent. The third entry was triggered at $16.09 in February 2018 with the exit occurring at $17.54 in May 2018 resulting in a small profit of 9 per cent.

Are you starting to appreciate the low risk nature of this strategy? Unfortunately, too many traders are focused on trading short term using daily charts and, consequently, fail to see the bigger picture of what is actually unfolding on the weekly chart, which is far more profitable and much less work, as it allows you to simplify your trading. In essence, Dow Theory allows you to trade with the direction of the trend, which is why this technique is so effective.

As you can see in the chart above, the last exit in May 2018 demonstrates how using Dow Theory can protect your capital against significant losses. This brings me to one of the most important factors in becoming a successful trader. It is not how much money you make over time that is important, it is how much you do not lose that will determine your long-term success.

Would it surprise you to know that if you held Bellamy’s from the first entry to the present, you would be sitting on a loss of around 27 per cent. But as you can see, by applying a simple strategy, such as Dow Theory you would have made over 100 per cent on your capital and more than doubled your initial investment.

Now that you have a basic understanding of how to buy and sell using Dow Theory when investing in the share market, you need to practice this skill so that you become comfortable identifying the signals. You also need a trading mentor because as I previously mentioned, there is no substitute for structured training when it comes to investing your hard earned money in the stock market.

Others who read this article also enjoyed reading: