Learn How to Trade Stocks / Shares

By Dale Gillham

Learning how to trade stocks can be a great way to build your personal wealth but only if you know what you’re doing.

A wise person once told me that investing without knowledge is gambling. At the time I tended to agree, but it wasn't until I started learning how to trade shares that I really understood the essence of this message.

The truth of the matter is, there’s a vast difference between knowledge and understanding. In the more than 30 years I’ve been studying the stock market, the most valuable thing I’ve learned about trading shares is that gaining knowledge is one thing—what's even more critical to your long-term success is gaining the right knowledge and understanding and how to use it correctly. This alone separates those who try and struggle to trade from those who achieve success.

But what is the right knowledge and how do you find it, I hear you ask. What I share below has been gained from more than three decades of being a professional fund manager, private trader, educator, and mentor that will start you on the right path. Where you go from here is up to you, however, I highly recommend you stick to trusted experts and stay away from those who push hype and high returns.

The important thing to remember if you’re contemplating trading is that there are two components that must align so you are successful. One is the knowledge of how to trade and the other is the skill of trading. Given this, it is crucial that you go beyond what most do in merely learning how to trade shares, you need to also gain the knowledge and understanding needed to generate consistent profits.

In this article, I’ll share with you the key things you need to know to not only learn how to trade stocks but to also establish a share trading strategy that will deliver consistent long-term growth.

What is stock or share trading?

It’s always best to start with some basic definitions so you know you’re on the right page from the get-go. Let’s start by explaining exactly what stocks and stock trading are.

What are stocks or shares?

Stocks or shares (these terms are interchangeable) typically represent a portion of ownership or equity in a company. You can also purchase shares in other investment products, such as Australian real estate investment trusts (A-REITs), listed infrastructure funds (LICs) listed managed funds and exchange-traded funds (ETFs).

When you buy shares, you (along with the other shareholders) own a part of that business or entity and the right to share in its profits. This could come in the form of capital gains (the increase in value of the shares you own) or the payment of dividends (payments made to shareholders out of the company’s profits).

What is stock trading?

Stock or share trading is essentially the buying and selling of stocks or shares. In its simplest form, it is the purchase of an asset (the share) with the intention of selling it at a later date for a price higher than you purchased it for.

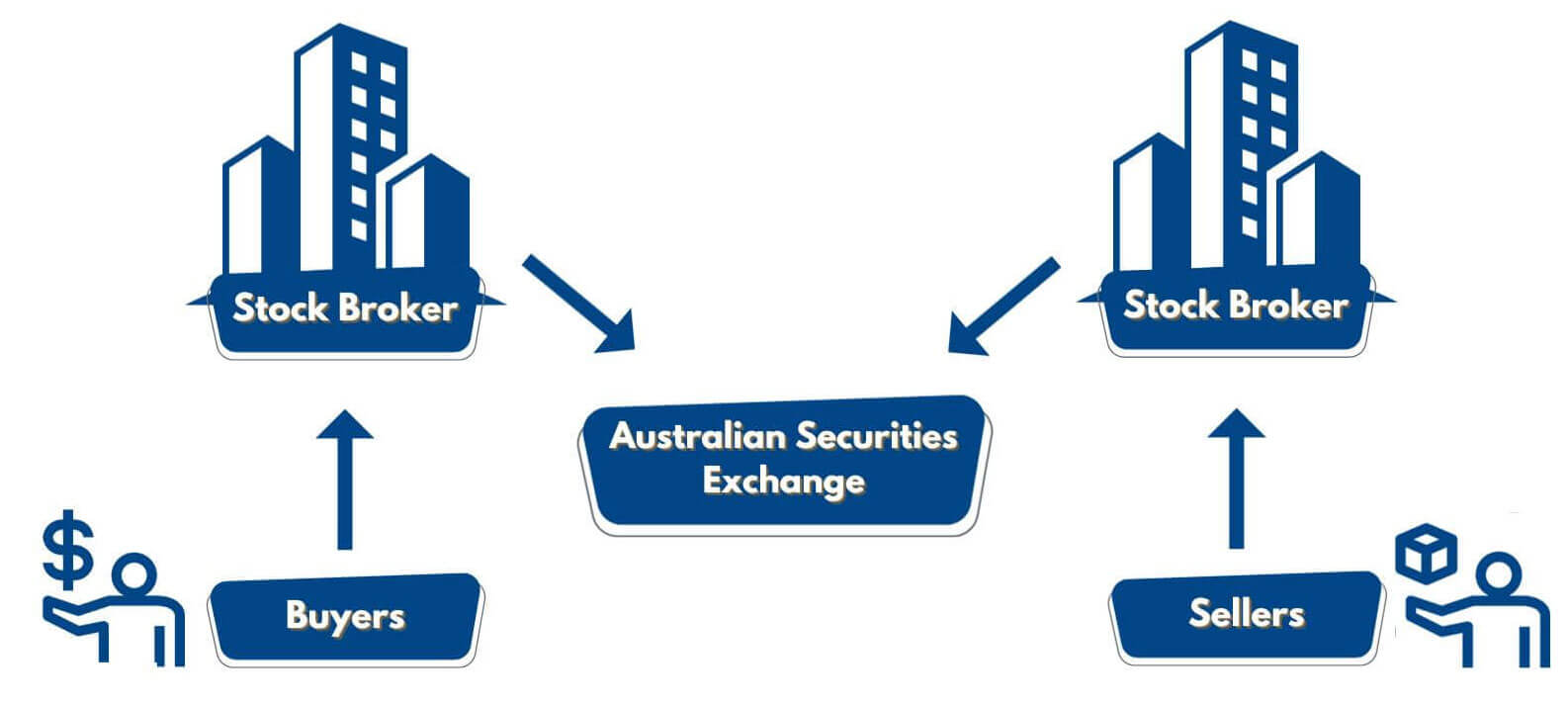

This process happens through a centralised stock exchange. In Australia, the primary stock exchange is called the Australian Securities Exchange (ASX).

There are a few participants involved in the trading and settlement of individual stocks:

- buyers who want to purchase shares;

- sellers who want to sell their shares;

- brokers (either online stock brokers or advisory brokers) who are licensed by ASIC to facilitate the buying and selling of shares; and

- the ASX who facilitates the trading, settlement and clearing of the trades.

Relationships within the share trading landscape

It is important to understand that the price of an individual share often differs from its value. The intrinsic value of a share is determined using accepted accounting standards that all ASX-listed companies must follow and report to the market half-yearly and yearly.

The price that a stock trades at on the ASX, however, is determined based on the rules of supply and demand, which are affected by the current market conditions and our view as to whether the price of the stock will rise or fall in the future.

Essentially, the trader is looking to profit by assessing the level of supply and demand for a stock. If the trader deems that demand will be high and that price will rise accordingly, they will buy. Conversely, if they identify that demand will be low and the expectation is for the share price to fall, they will sell.

If you're considering investing in shares for the first time, I strongly recommend you read Investing in Shares and Stocks for Beginners, which provides plenty of helpful information you'll need to start trading.

Types of stock trading

There are several different strategies that traders typically follow based on:

- their financial goals,

- their level of knowledge and experience,

- how heavily involved they want to be in their trading, and

- how long they want to invest for.

While these are broadly categorised as either long-term or short-term, the most common types of stock trading include:

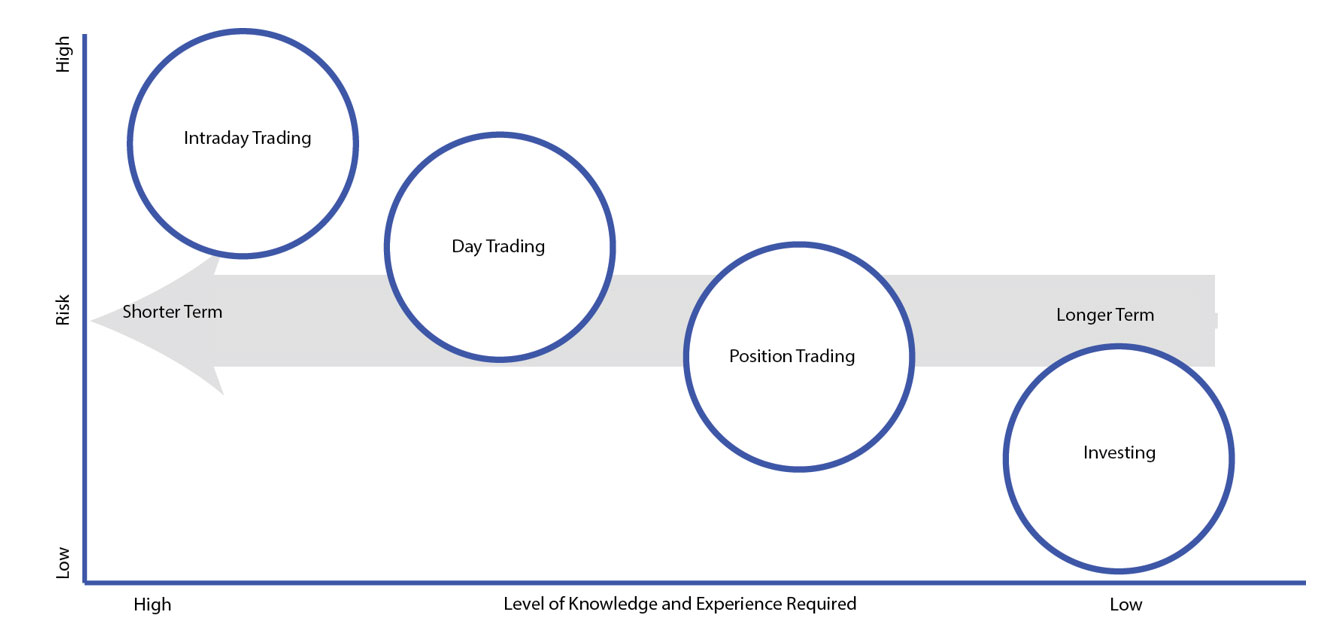

- Intraday trading: Short-term trading where shares are bought and sold within a single day.

- Day trading: Sometimes called swing trading or buying in the dips. This is a comparatively short-term trading strategy where shares are bought and sold within a day or over several days. Traders enter a trade when a confirmed change in the short-term direction of price occurs.

- Position trading: A medium-term approach to trading that aligns with the theory of buy low and sell high. The trader holds trending shares to capture price movements in a trend, starting from the confirmation of a low until the trend is exhausted.

- Investing: A long-term approach to buying and holding shares over many years. Unlike the above methods, this strategy is not about fine-tuning your entry and exit points rather it is about finding individual stocks that are below their true value and holding them over the long term.

The different types of stock trading

Types of analysis

If you want consistency as a trader, then how you arrive at your decisions to buy or sell comes down to the analysis you perform regardless of the type of stock trading you do. Let's look at the two types of analysis that successful investors and traders rely on to arrive at their decisions.

Fundamental analysis

Fundamental analysis is an analytical approach to investing that is mainly used to trade over longer timeframes. Trades are based on various metrics using the data reported by the listed company such as their level of profit, future earnings estimates and debt levels. Common methods used to determine the future value of the stock include the Price-Earnings ratio (PE) and Earnings per Share (EPS). Traders may also factor in events that might affect the anticipated growth or decline of a company such as interest rate rises.

Technical analysis

Technical analysis is an analytical, data-driven approach where analysts apply tools to past price and time-based data on bar or candlestick charts, for example, to determine patterns in a stock’s behaviour. Trading decisions are based on identifying patterns that historically provide a high degree of certainty that the stock will move in a particular direction in the future.

Which method of analysis should I use?

Depending on the type of trading you want to do will determine the method of analysis you apply. As shown in the image above, there is an inverse relationship between the level of knowledge and experience you require to trade and the timeframe and type of trading you do. Intraday or day trading is very short term and high risk, which is why you require a high level of knowledge and skill to be successful over the long term. As such, you will need to be proficient in technical analysis to undertake this type of trading.

Investing, on the other hand, is a lower-risk, longer-term strategy that requires less knowledge and experience, which is why fundamental analysis works well with this method of trading. However, if you choose to undertake position trading, you will benefit from combining both fundamental and technical analysis.

Can you teach yourself to trade stocks?

Anyone can master the basics of buying and selling stocks, however, this is only part of the process of trading. A proficient trader is someone who has a well-formulated plan that they stick to so that they are consistently profitable. As such, learning how to trade stocks profitably and consistently can be more challenging.

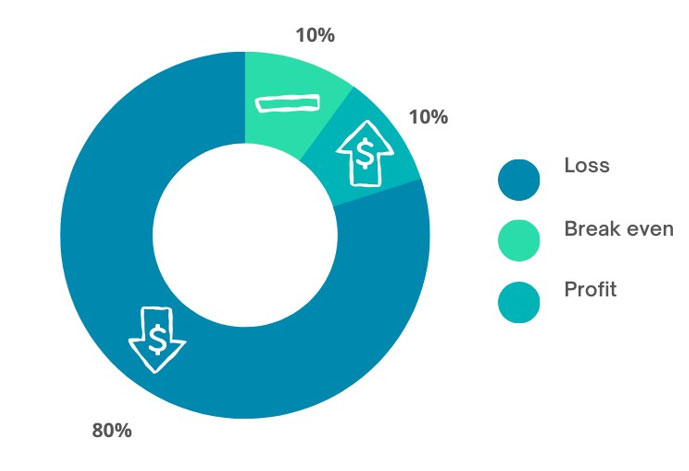

Here’s an interesting statistic for you—only 10 per cent of traders consistently make a profit. That means 90 per cent of traders either break even or lose money in the stock market.

The likelihood of stock market success

There is a wealth of information out there to help you learn how to trade stocks but it's important to understand there is a vast difference between information and education.

While teaching yourself how to trade stocks is absolutely achievable, it typically comes with significant costs in both lost time and capital. This is because it will generally take you three to ten times longer than if you study a well-structured trading course, as you need to search for information and test its appropriateness. It also comes with higher risks and inconsistency in your trading results.

The reality is that learning how to trade stocks is only the first step. If you’re wondering why most traders fail, let’s circle back to what I mentioned earlier. The key to becoming a successful trader isn’t just about knowing how to trade shares, it's about having the skills of a trader and the knowledge and understanding of how to apply those skills to your advantage.

Remember, share trading comes with some very real risks, and without an educated understanding of how to navigate market shifts and fluctuations safely, you can very quickly lose your hard-earned money.

What are the challenges when learning to trade stocks?

With around 90 per cent of traders either losing money or breaking even, it’s clear that stock market trading is fraught with challenges. Get it right and it comes with great rewards but if you get it wrong it can cost you dearly.

That's why it pays to understand the biggest challenges that traders face when learning to trade shares.

1. Get rich quick mentality

Novice traders often mistakenly believe stock trading is a way to get rich quickly with very little time or money.

In reality, successful traders invest a significant amount of time in obtaining the necessary education, knowledge, skills and experience that will equip them with the tools they need to build wealth over the long term. There is also a financial investment you need to make as your education will cost you one way or another. You will either invest in a solid trading course or you will invest more time and capital through what many refer to as the school of hard knocks.

2. Not knowing how or when to sell stocks

Most traders struggle to know when to sell their stocks.

Traders are typically armed with many theories about how to pick the best stocks and will focus around 80 per cent of their time trying to find trades that fit their criteria. Comparatively, most devote very little time to deciding when to sell.

3. Failing to set stop losses

Many traders either fail to set stop losses or set them too tight. Mostly this is because they are trading to not lose, which causes them to lose more.

Trading is about minimising risk, not maximising profits. Stop losses are an important tool that provides valuable protection against the risk of losing your capital and profits. To be consistently profitable, traders not only need a clear understanding of how and why they are entering a trade but also when and where they will exit.

4. Poor risk management

A lot of traders struggle because of poor risk management, as they fail to work out how much their willing to lose or how far they will allow a stock to fall before they exit. Part of this is because they use incorrect tools and or strategies for the type of trading they are attempting. It is very common to see traders using a day trading strategy when looking to position trade or day trade using tools more congruent with position trading.

When you decide to purchase a particular stock, it’s important to decide how much risk you’re willing to take and that the risk needs to be aligned with your goals. It’s also important to understand the concept of diversification to ensure you don’t over-diversify your portfolio.

5. Trading on the emotions of fear and greed

Fear and greed can be a major psychological trap, as most traders tend to act more on emotion rather than logic when losing money.

When faced with the fear of a loss, many traders adopt a micro view of the market, watching their trades daily (or even intra-daily) and making trading decisions based on short-term market volatility. This ultimately leads to over-trading as they chase the market to regain lost capital or profit.

This knee-jerk reaction occurs when traders don’t trust themselves, their skills or their trading plan, and this usually stems from having a low level of knowledge and experience. The fear of a loss is also amplified when there is little or no long-term trading strategy in place.

6. Overuse of daily charts

Many traders fall into the trap of overusing daily charts. You need to understand that stockbrokers and other market participants make money when you trade, and the more you trade, the more they make. This is why most traders are told to use daily charts when learning how to trade shares, however, in my experience, their overuse is a major reason why most day traders overtrade. Over-trading results not just in higher fees but takes a greater amount of your valuable time only to result in poor returns.

Daily charts only show the short-term movement of a stock or the wider market, what they fail to provide is a complete picture of longer-term trends that will dominate future price moves. Daily charts effectively amplify the traders’ emotions resulting in higher levels of fear and greed. This causes traders to enter more short-term trades without proper analysis and reason.

7. Overuse of leveraged trading

It's also common for those starting out to want to trade highly leveraged markets (such as Forex, options and other leveraged instruments) but the use (or poor use) of leverage can lead unskilled traders or investors to trade on emotion.

The lure of leveraged markets is that they can be volatile and prone to extreme fluctuations thus enabling the trader to profit quickly with smaller amounts of capital. They can also do the opposite and few traders ever consider the very real possibility of losing 100 per cent of their capital within hours or even minutes. Traders should never consider leverage trading until they’ve proven to themselves that they can be consistently profitable trading individual stocks.

8. Trading on hot tips

Many get into the stock market after hearing about a ‘hot tip’ from their family or friends—but it's important to remember that you should never trade on a tip until you understand why the stock is moving.

It’s important to understand the fundamentals of a company and carefully analyse a stock chart before risking your hard-earned money, as there are never any guarantees in trading or investing.

9. Not taking a long-term perspective

Creating real wealth, replacing your income and indeed becoming a full-time trader so you can trade for a living is a long game and not something you just do for a few weeks or months. It’s easy for novice traders to focus on short-term gains and forget the importance of taking a longer-term approach to being successful. As they say, Rome was not built in a day so being successful is not about finding the next stock that will rise 100 per cent or more, it is about gaining consistency.

Stock prices will always move up and down in the short term, therefore, it's more important to consider the medium and long-term trends when analysing stocks you want to buy or sell as this will help you gain consistency. While someone you know may make real money for a short period of time, it is only those who are consistent that will trade successfully year in and year out.

Learn how to trade stocks profitably

Once you have an understanding of the key challenges you’ll face when trading the stock market, you can turn your attention to understanding what it takes to trade stocks profitably.

To quote Einstein, “education is the progressive realisation of our ignorance”. This ultimately means we don’t know what we don’t know. In my experience, the majority of those who trade shares do so with very little knowledge, blissfully unaware of what they don't know until it costs them a lot of money.

Learning how to trade shares successfully is an ongoing process, especially if you want to earn your place among the 10 per cent of traders that consistently profit from their investments. Given this, I encourage you to follow these steps.

1. Set clear goals

Clearly establish what your financial goals and investment objectives are. Ask yourself why you want to trade and how would being a successful trader change your life. Do your greatest priorities relate to generating income or capital growth and how will having these make you feel? While trading is about generating capital gains and income, the goal of a trader is never about the money, it's about how having more money will change your life.

Identifying exactly what it is that you want to achieve early in the piece is important, as it will enable you to take a focused approach and make informed investment decisions.

2. Educate yourself

When starting out, it’s important to learn the fundamentals of investing in shares for beginners.

It’s also worthwhile taking a crash course on how to buy ASX shares to learn the basics including the terminology of different order types and how the stock market works.

Then, if you want to learn how to achieve consistently profitable results, it's a really good idea to complete a comprehensive trading course that will teach you how to apply both fundamental and technical analysis so you gain the confidence to navigate changing market conditions.

3. Learn to apply profitable stock trading strategies

It may surprise you to learn that I don't trade using common lagging technical indicators, such as Moving Averages, Moving Average Convergence/Divergence (MACDs) or Relative Strength Indicators (RSIs), which are commonplace with the majority of traders today.

I find that relying on these indicators is of limited value, as they only inform you of a move after it has already occurred. Individuals who use them generally place a lot more trades (which makes the brokers a lot more money) but results in very mediocre returns.

Instead, I use the leading techniques of masters such as Gann, Elliott and Dow that provide more consistent entry and exit signals. Using leading indicators means I am better placed to ‘time the market', which ultimately results in more consistent profits. While it requires a little more work to learn how to apply these techniques effectively, the effort is well worth it.

4. Develop a trading plan

To become a consistently profitable trader over the long term, you must develop a written trading plan.

Your trading plan should include:

- your buy/sell rules and other analysis

- your money management rules including your stop loss, and

- how you intend to manage the trade

It also needs to include your psychology rules and what you will do if a trade does not unfold as expected.

5. Practice with a demo trading platform

It is hard to have a good trading plan unless you test how effective it is. Testing your trading plan does two things, firstly it confirms whether your rules and analysis deliver the required results consistently. The second thing is that it tests your ability to apply your trading plan and doing this successfully gives you confidence.

There are multiple ways to practice your trading from doing it manually using spreadsheets to setting up a demo trading account with an online broker in a process called paper trading (using a stock market simulator which allows you to practise buying and selling).

Paper trading allows you to put your knowledge to the test, experiment with various trading strategies and gain experience without the risk. You’ll gain a clear understanding of the profitability of your trading strategy and how you will react when your trades don't perform.

Paper trading is also a great way to test a trading plan if you ever decide to adjust your strategy in the future.

6. Learn to manage your risk

Learning to manage risk is a critical skill to develop when trading stocks.

It involves implementing rules to manage the number of positions you hold in your investment portfolio, as well as the size of each trade. It also means applying risk management strategies, such as a stop loss, to protect your capital so you can maximise profits and minimise losses.

7. Start with a small investment

When you first start trading, it’s best to start small. Only invest a small amount of money that you can afford to lose if things don’t go to plan. This approach will allow you the opportunity to learn and experiment a little while minimising the amount of risk you are exposing yourself to.

Remember to also consider the associated brokerage fees when deciding how much you will invest in each trade, as this will have an impact on your profitability and potential losses.

8. Analyse your trades

You also need to assess the performance of each trade so you can learn from your wins, as well as your losses.

You'll gain insights into areas where you’ve done well and where you’ve made mistakes, which can be invaluable for refining your strategies and informing future trades.

A simple way to do this is to keep a trading log via a spreadsheet to track your progress, identify any areas where you may be falling short and monitor your overall win/loss and profit/loss performance. It will also act as an objective record of all the trades you have made. Ideally, you want to achieve a win/loss ratio of 70 per cent or higher across your stock portfolio.

9. Develop the traits of successful traders

There are a few essential traits shared by successful traders.

Discipline is possibly the most important, as it allows you to stay committed to your trading strategy regardless of market conditions and resist the temptation to make impulsive or irrational decisions when faced with losses.

Successful traders also tend to have a well-developed plan for success and have accumulated the knowledge and experience to implement it. They're able to assess market conditions using their tested trading plan, they use sound risk management strategies to protect their trading capital, and they stick to their trading rules, only making disciplined trading decisions.

Increasing your probability of success when learning to trade

Now that you understand the skills and knowledge required to trade stocks profitably, let's look at how you can increase your likelihood of success when learning to trade.

Possibly the greatest word of wisdom I can offer is to learn where to exit.

I mentioned earlier that trading is about minimising risk, not maximising profits—having solid exit strategies in place is the easiest way to ensure you let your profits run and cut your losses short.

Why stop losses increase your profitability

I cannot emphasise enough the importance of using stop losses when trading the stock market.

Regardless of whether you are trading or investing, everyone needs to have an exit strategy each time they trade. Without one, you’ll be assuming unnecessary risks, which means fewer profits and bigger losses.

Setting a stop loss before entering a trade is by far the best way to minimise the amount of risk you expose yourself to, and when used in combination with a solid trading plan, the result is a winning formula for stock market success.

When setting a stop loss, it needs to be far enough away from your entry price to allow the trade to settle into the trend, but close enough to protect your capital.

There are various stop losses you can use depending on what you are trading, and you may adopt a different stop loss for different types of shares and trading styles, but as a rule of thumb, I always set my stop loss 15 per cent below my purchase price when trading blue chip shares (although this will vary depending on the volatility of the stock).

Biggest dos and don’ts when learning to trade shares

No matter what your goal is when it comes to trading, it's essential to your long-term success as a trader that you avoid following the herd (or the 90 per cent of traders who fail). Instead, make sure you’re following the rules and principles of the 10 per cent of traders who are consistently profitable.

To help you do exactly that, I thought I’d summarise by sharing my biggest do’s and don’ts that I encourage everyone to follow when learning how to trade stocks.

| Dos | Don'ts |

|---|---|

| |

|

|

|

|

|

|

|

|

While learning how to trade stocks can seem to be a daunting task it doesn't need to be. Anyone can become a profitable trader, all it takes is to equip yourself with the right knowledge and have the discipline to apply it effectively.

To learn more of my winning tips and strategies, invest in a copy of my latest award-winning book Accelerate Your Wealth, It's Your Money, Your Choice which is filled with simple but powerful investment strategies.

You should also take a look at these video testimonials and reviews to discover some trading success stories from our clients.

Others who read this article also enjoyed reading: